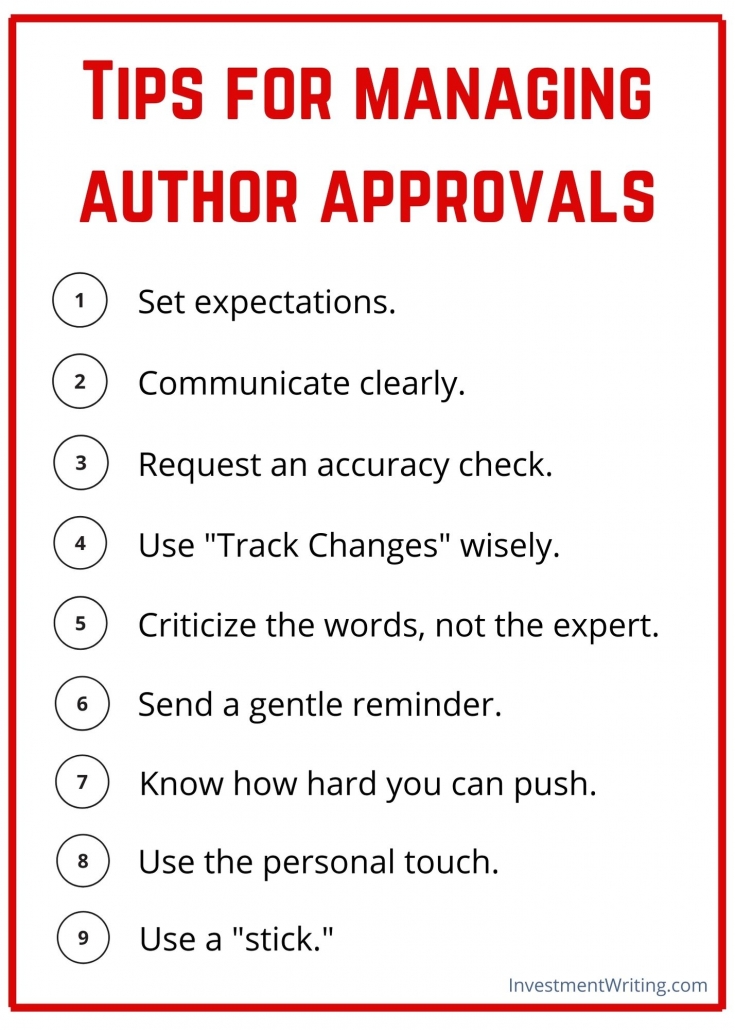

Tips for managing author approvals

Managing author approvals can challenge the patience of financial writers and marketers. The process can be equally distressing for authors, if it’s not done well.

Here are some tips that will make managing author approvals easier for you.

1. Set expectations

Educate your subject matter experts about the process. Start by telling them the purpose and timeline of the piece they’re helping you with. They’ll be more helpful if they understand why it’s important.

2. Communicate clearly

Put your deadline for comments in the subject line of your email seeking approval. Here are a couple options:

- Due March 2—check attachments

- Pls review by MARCH 2: white paper attached

Reinforce your message by repeating the deadline in the body of your email. It could start like this: “By MARCH 2, please …”

3. Request an accuracy check

Don’t ask for “edits” or “suggestions.” That can lead to an unnecessarily wide-ranging rewrite.

Instead, ask the expert to “check for accuracy.” This, at least theoretically, limits the scope of their edits to what’s essential.

I often say, “Please check that my edits haven’t introduced any inaccuracies.”

4. Use “Track Changes” wisely

I send drafts to my clients with “Track Changes” turned on. I want them to highlight their changes in the drafts they return to me. That allows me to pay closer attention to edits they make. Those are the spots where typos, clunky wording, and information that disrupts the document’s flow are likely to sneak in.

I leave Track Changes turned on while I edit a draft. That helps me check my work before returning it to the client. If I make substantive changes, I use Microsoft Word’s “Comment” feature to explain the changes. However, after I make those comments, I typically accept all changes.

I don’t highlight all of my changes because most clients aren’t interested in nitpicky details. I accept all changes to spare authors those distractions. Instead, they can focus on the substantive changes I’ve highlighted. I typically identify significant changes using a Comment that will appear in the right-hand margin of the article.

5. Criticize the words, not the expert

You may need to push back against edits made by the expert. When that happens, criticize the words, not the expert.

For example, don’t say “I hate the way you wrote this.” (I’m exaggerating to make my point.) You may be able to rewrite the sentence without comment. Or, you could say, “Here’s a streamlined sentence that makes the same point.”

6. Send a gentle reminder

Has your deadline passed, and are you still waiting for comments?

Your subject matter experts have many demands on their time. Your needs are not their top priority. Because of this, they don’t always finish their work for you on time.

The first time an expert misses a deadline, send a gentle reminder. Consider using a sentence such as, “I imagine you’ve been busy, so you weren’t able to send your feedback by the deadline.” However, reinforce the importance of your revised deadline by reminding the expert of its importance to corporate goals.

7. Know how hard you can push

“If I don’t hear from you by [DATE], I’ll assume that you approve this document.” That’s a bold statement that I was able to make at a staff job, when I had the backing of my boss. Don’t do this unless you are confident of your boss’s backing. In any case, it’s better to get the expert’s approval. I always did.

8. Use the personal touch

When I worked on staff for an asset management firm, I’d sometimes walk to an expert’s office to request approvals. It often worked.

If you work offsite, a phone call can help you cut through the clutter in the expert’s inbox.

9. Use a “stick”

If you’re an outside writer, you can apply a “stick” as incentive for your client’s staff to move along the approvals. My agreements typically have a clause that requires final payment after the first submission or “when feedback on the first draft becomes overdue.”

Your ideas?

If you have ideas about how to managing author approvals, I’d love to hear from you.

You may find more ideas in my posts on getting employees to follow style guidelines and managing difficult portfolio managers.

The image in the upper left is by Majays31 [CC BY-SA 3.0]