Who are the fixed-income commentary winners–and why?

Learning about new sources of fixed-income commentary was the biggest benefit of running my survey about “Who writes the best fixed-income commentary?” (see the original survey, which is still open for comments). You’ll find the recommendations of my industry connections below.

The survey also showed me what financial professionals think makes fixed-income commentary great. I’m grateful to my LinkedIn connections, including many professional investors, who shared their insights. I’m no bond geek, so I enjoyed learning from the professionals. Although survey participants were anonymous, I believe that many of the respondents come from among the fixed-income professionals whom I asked to take the survey.

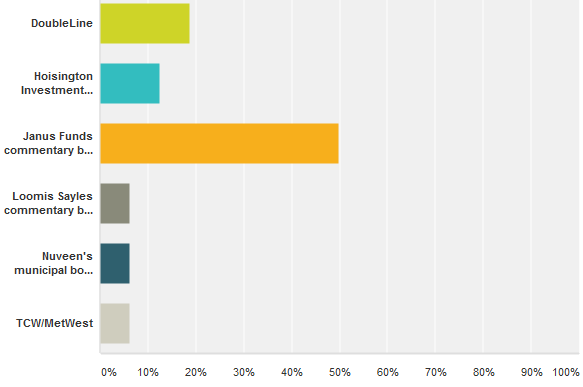

The race for the #2 spot

Bill Gross of Janus Capital killed the competition in this survey. He racked up 50 percent of the vote. This doesn’t surprise me. After all, he’s one of the first portfolio managers whom most people think of when asked to name a fixed-income commentator.

My initial survey asked people to vote on a predetermined slate of candidates, which I’d collected via LinkedIn. But it also allowed for write-ins.

Below are the winners from among the names suggested for votes, along with comments that survey respondents made about them. I’ve included a link to what seems to be the best source of the investment commentary that my respondents enjoyed. I’ve also shared some of the respondents’ comments on the contenders.

- Janus commentary by Bill Gross—Respondent 1: “Authoritative – influences conversation and identifies themes that everyone else parrots.” Respondent 2: “Touches on the macro issues driving the fixed income markets in a way that usually engages the reader. Tangents make it interesting.” Respondent 3: “I don’t typically work with fixed-income securities, but regularly read Bill Gross’ reports to help find interest rate trends and get insights into where bond yields/inflation might be heading. Bill’s commentary always comes with personal anecdotes, light humor, and likeability.” Respondent 4: “He has a breezy, confident style that draws you in. Bill has written for decades, and has a clear ‘voice.’ He used to read it aloud in a podcast, and his cadence and phrasings are quite distinctive and natural.”

- DoubleLine

- Hoisington Investment Company—”Lacy Hunt is great Fed watching commentary“; “Opinions expressed are based on big picture macro views.”

- Loomis Sayles commentary by Dan Fuss—The PDF commentary for the Bond Fund seems a bit bland compared to the colorful commentary that I’ve heard Fuss share in presentations to the Boston Security Analysts Society. Perhaps his fans are responding to his commentary delivered on TV or in interviews. Or perhaps there is meatier commentary hiding elsewhere on the Loomis Sayles website.

- Nuveen’s municipal bond commentary by John Miller

- TCW/MetWest—”TCW MetWest has, in our opinion and for our investment consulting purposes, the best quarterly fixed-income market commentary. They release talking points shortly after quarter-end and then a more developed review a couple of weeks later.”

More fixed-income commentary contenders

A number of people wrote in suggestions that weren’t included in the vote tally. I’m including their comments, when appropriate. I also include a link to what I believe are the online sources to which survey participants referred.

- BCA Research (this is a paid service, but you can sample the firm’s insights on The BCA Blog)—”It’s designed to meet my needs and interests and not those of the firm sponsoring the commentary.”

- Bloomberg Credit Research team (you’d need a Bloomberg terminal to access their content)—”The insights are fantastic and because it is on the terminal, I can easily use their charts and graphs and Excel sheets.”

- Bond Squad, a paid service—”independent, frank, timely, unconflicted, and written by someone who has worked with both institutional and retail investors for 30+ years. I consider daily e-mails/weekly longforms must reads.”

- Brean Capital’s Peter Tchir (@tfmkts) who blogs on Forbes—for “macro strategy and asset allocation. Brean’s stuff…takes you through an argument for or against a positioning or the rationale for a market move and how to benefit by it. It’s about info and context.“

- Cumberland Advisors—no one commented on this commentary’s strength, but I used it to illustrate my first-sentence check approach to editing your own writing.

- Goldman Sachs Asset Management—”great weekly letters, on a variety of topics including the broader economy, but often is insightful and more timely than quarterly pieces, especially since the markets seem to move faster these days than ever before.”

- Grant’s Interest Rate Observer, a paid service—gets into issuer-level detail that is a bit deeper than some need.

- Janus Capital’s Fundamental Informed quarterly commentary—”The piece is more formal than Bill’s at times bizarre monthly commentary and takes a serious look at what is driving their fixed-income decision-making.”

- Guggenheim—”not as product driven as many others, tends to have more independent views and writes on a sophisticated level rather than for general retail investor audience”

- Municipal Market Analytics‘ Matt Fabian (paid service)—”Clear and concise combination of economic, fundamental, technical, political [factors]”

- Oaktree Capital’s Howard Marks—”Topical” and “really insightful”

- PIMCO’s Harley Bassman—”Experienced, easy to read”

- PIMCO, other sources—”We don’t rely on any general market commentary from PIMCO, but rather read their ad hoc stuff religiously. But the real gem out of PIMCO is usually their verbal comments on webcasts (like on AssetTV) if you can see past their infomercials (ie, they plug themselves shamelessly).”

- The Rieger Report on the Indexology Blog of S&P Dow Jones Indices—”The information provided is independent and unbiased. The reports are not trying to sell or convince anyone to invest in a particular product instead they are arming investors with information to make decisions.”

- Wilmington Trust’s Stephen Winterstein—”He presents an interest-rate agnostic view of the fixed income world (in other words he doesn’t waste time focusing on the unknowable . . . interest rate directionality). He does focus on credit analysis and larger geographic trends where his experience and conviviality shine.”

Explaining why they didn’t go with one of the big names, one respondent said, “In general I feel that [Doubleline’s Jeffrey] Gundlach and Gross ‘talk their book’ in their commentaries. They are good to read, but with a jaundiced eye (I am a fixed income guy!)”

What makes fixed-income commentary great?

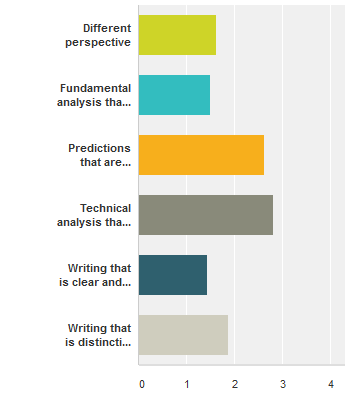

Survey respondents gave roughly equal top billing to the following characteristics of great commentary, ranking the characteristics on a scale from 1 “Most important” to 5 “Not at all important”:

important”:

- Fundamental analysis that’s good—one respondent said, “Facts and figures are great but context and implications are key.”—Average ranking 1.5

- Writing that is clear and easy to understand—I was delighted with the comment that “To be GREAT, it must be concise and jargon-free, or at least low-jargon.”—Average ranking 1.5

- Different perspective—Average ranking 1.63

Next came “Writing that is distinctive and colorful.”

Lagging far behind were “Predictions that are accurate” and “Technical analysis that’s good.” As for accuracy of predictions, on respondent said, “I actually think it’s more important to understand their rationale (and agree or disagree) rather than merely accept anyone’s opinion as fact.”

Another factor, which I gleaned from comments on respondents’ favorite commentators, is that my respondents liked commentary that focused on the readers’ needs, rather than on promoting the firm or its investment strategies. That makes it tough for fund managers to excel.

How great fixed-income commentary differs from great commentary about other asset classes

Here’s my summary of what people said in their open-ended comments about what distinguishes great commentary about bonds:

- It matters more, said a respondent who believes that “bond markets drive stock markets long term.” On a related note, another respondent said, “Fixed income is the area that is most important to identifying global-macro trends and future economic prospects by looking at the current situation on yields vs. interest rates and where they are headed; stocks are volatile and always changing; other asset classes are in a league of their own.”

- It’s more oriented to the longer term, with “less emphasis on daily tactical or daily news type of hyperbole.”

- It’s more diverse because each bond sector has unique characteristics.

- It shows awareness of whether the buyers are investors or traders and the diverse purposes (total return/income/diversification/safety) for which fixed-income is used.

- Unlike commentary about stocks, which is about stories, commentary about bonds, is “about stories as well as math, f/x, economics, and liquidity.” This seems to relate to another person’s comment that “Fixed income commentary should be based on top-down analytics.”

Annoying habits of top fixed-income commentary writers

The commentators whom I’ve discussed would be even better if they could clean up some issues with their writing and presentation, in my opinion.

Here are the annoying habits that I noticed as I viewed their writing samples.

- They are guilty of “Bloggers’ top two punctuation mistakes” and other usage mistakes. I can understand their firm’s editorial staff allowing them to have distinctive voices. However, I’d like to see the editors rein in outright mistakes, such as writing “the gap has broached” instead of “the gap has breached.”

- They use too much jargon, especially if their commentary is aimed at individual investors. They could learn from Donald Trump and ask themselves “What would The Wall Street Journal do?“

You can improve YOUR investment commentary writing with my June 23 webinar.