May newsletter: Better quarterly commentary

Want to do a better job on your next quarterly commentary?

You’ve finished your first-quarter commentary, but you have a nagging feeling you could have done a better job editing it. Check out the five-step process in my blog post on “5 steps for rewriting your investment commentary”!

Also, if you’re writing for an audience of individual investors, pay attention to my list of “Words to avoid in your investment communications with regular folks.”

Also, if you’re writing for an audience of individual investors, pay attention to my list of “Words to avoid in your investment communications with regular folks.”

You might also enjoy “Investment commentary numbers: How to get them right.”

For a handy overview of my approach to investment commentary, you can buy my mini e-book.

Is that really a word?

I sometimes ask my clients to substitute a different word when they use a word that’s not in the dictionary. However, if you think that we ought to be more flexible about counting words as “real,” you’ll enjoy “What makes a word ‘real’?” a TED talk. I think she has a point when she says that usage should eventually affect correctness.

I admit that I’m one of those people the speaker discusses who complains about the incorrect use of the verb “impact.” See the MLA Style Center on “Impact as a verb” for an explanation. Also, see “affect/effect/impact.”

Pursue diversity for better investment results!

The CFA Institute attracted close to 800 registrants to its March 2024 conference, “Thrive: Enhancing Outcomes through Collective Intelligence,” which made a business case for why the organization and many of its leading members are committed to pursuing diversity, equity, and inclusion (DEI). Below are some ideas that interested me.

British neuroscientist Hannah Critchlow talked about how you can use “groups of brains” to balance out biases if the group is truly diverse in genes, experience, and age. You must also ensure that the diverse group can communicate freely so don’t get an echo chamber. To achieve that, she suggested techniques such as letting the junior person speak first (which I would find intimidating if I were on the spot like that) and letting people submit ideas anonymously.

It’s hard to prove the benefits of diverse teams for investment performance through a scientifically rigorous study. That’s because, as Wylie Tollette, head of client investment solutions at Franklin Templeton Multi-Asset Services, said, that would take 30 years and a double-blind study, but no one would want to be in the control group.

Daryn Dodson, managing director of Illumen Capital, shared the startling finding that as black fund managers outperform, they face more bias and misallocation. I believe he was referring to this study: “Race influences professional investors’ financial judgments,” which he coauthored. Here’s an excerpt from the summary:

Asset allocators favored the White-led, racially homogenous team when credentials were stronger, but the Black-led, racially diverse team when credentials were weaker. Moreover, asset allocators’ judgments of the team’s competence were more strongly correlated with predictions about future performance (e.g., money raised) for racially homogenous teams than for racially diverse teams. Despite the apparent preference for racially diverse teams at weaker performance levels, asset allocators did not express a high likelihood of investing in these teams. These results suggest first that underrepresentation of people of color in the realm of investing is not only a pipeline problem, and second, that funds led by people of color might paradoxically face the most barriers to advancement after they have established themselves as strong performers.

The conference was the first DEI-focused event I’ve attended to feature an Indigenous presenter, Geordie Hungerford, CFA, CEO of the First Nations Financial Management Board, who spoke on “Reshaping the Inclusion of Indigenous Communities in Investment.” He said that Indigenous people make up only 6% of the world’s population but are stewards of about 80% of the world’s remaining biodiversity. I thought about that when I read a Boston Globe article about an art exhibit that:

…asks you to imagine that “the future is Indigenous,” drawing on the collective knowledge of native peoples all over the world who managed their respective ecosystems very nicely before industrial-minded colonials came along and ruined everything. Or in its own words: “A Western lifestyle that relies on extraction and pollution has disconnected most of the global population from the rhythms and systems of the earth.”

Bookmark my blog, and visit it on the first Tuesday of every month!

If you’d like to keep up with my newsletter, please bookmark my blog and visit it on the first Tuesday of every month.

What my clients say about me

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Susan has an exceptional ability to tailor investment communications to the sophistication level of any audience. She has an uncanny ability to make very complex investment and/or economic topics accessible and understandable to anyone.”

“Susan’s particularly good at working through highly technical material very quickly. That’s very important in this business. A lot of people are good writers, but they have an extensive learning curve for something they’re unfamiliar with. Susan was able to jump very quickly into technical material.”

Improve your investment commentary

Attract more clients, prospects, and referral sources by improving your investment commentary with 44 pages of the best tips from the InvestmentWriting.com blog.

Tips include how to organize your thoughts, edit for the “big picture,” edit line by line, and get more mileage out of your commentary.

Available in PDF format for only $9.99. Buy it now!

Boost your blogging now!

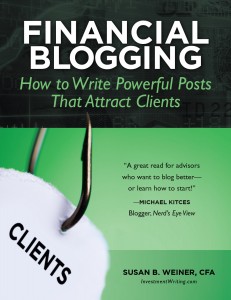

Financial Blogging: How to Write Powerful Posts That Attract Clients is available for purchase as a PDF ($39) or a paperback ($49, affiliate link).

Hire Susan to speak

Hire Susan to speak

Could members of your organization benefit from learning to write better? Hire Susan to present on “How to Write Investment Commentary People Will Read,” “Writing Effective Emails,” or a topic customized for your company.