Financial communications during the coronavirus crisis

I wish I had a magic bullet for your financial crisis communications during a time of coronavirus and big market declines. I don’t. But I want to help you, which is why I jumped at the opportunity to watch a March 18 webinar delivered by consultant Nick Richtsmeier, whose presentation at the 2019 NAPFA Fall Conference had impressed me. The webinar was called “Mediocrity is Viral. Differentiated Marketing During Turbulent Times” (replay available with free registration at the link).

Framework for financial crisis communications

Richtsmeier explained that businesses struggle with what to say and how to engage during a crisis. However, the ways that we and our companies respond tell clients what we’re really made of.

Individuals and companies respond to crises in one of three ways, said Richtsmeier: fight, freeze, or flight. A “fight” response reflects a need to change the status quo. However, fight responses may be seen as “careless or cavalier,” he said. “Freeze” is the most common response, in Richtsmeier’s experience, and the related lack of action can be seen as “unstable and fragile,” he said. Finally, the avoidance and “willingness to ignore the facts” associated with “flight” can be seen as “being out of touch with reality.”

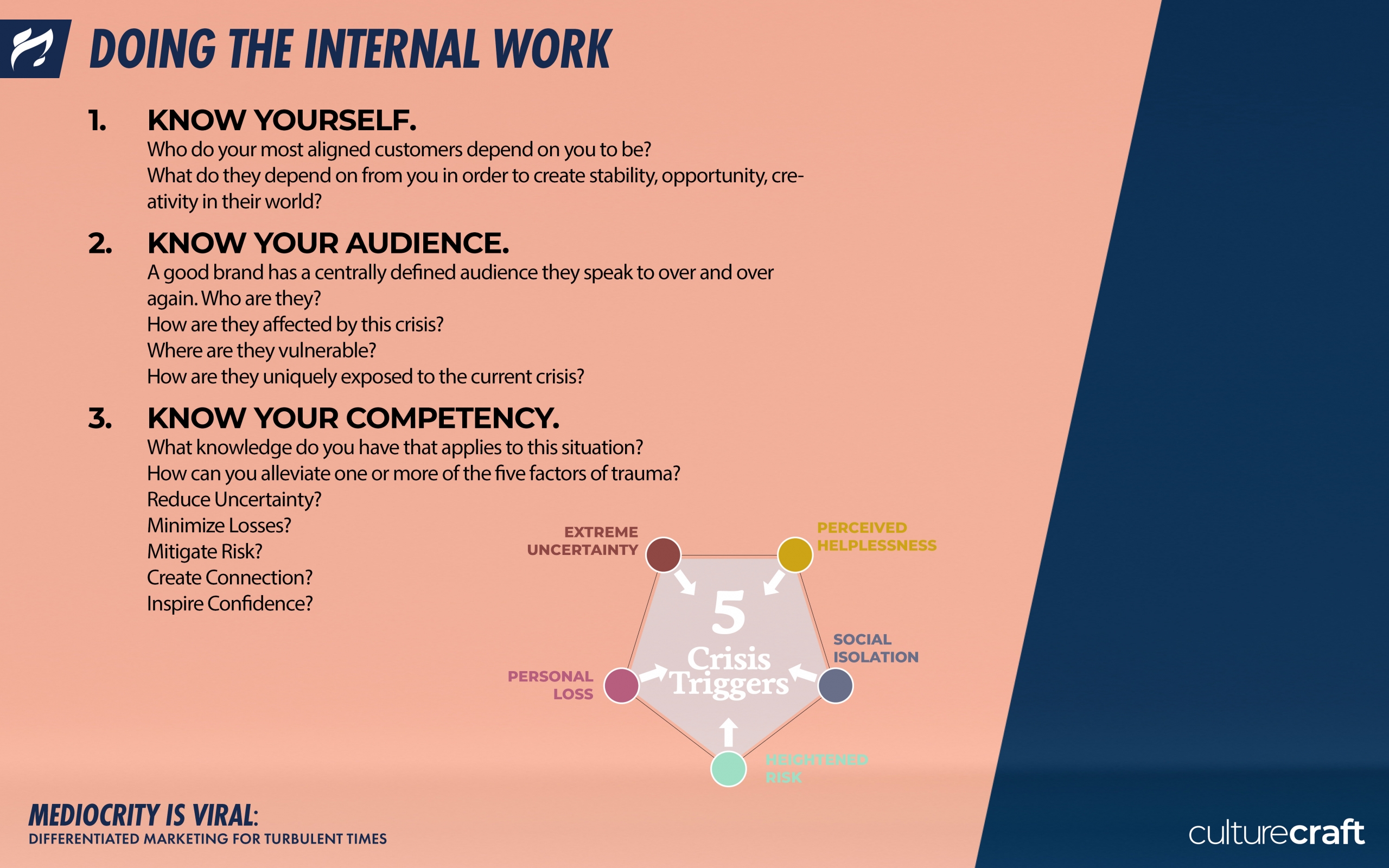

None of these is a perfect solution. So, what’s a communicator to do? This is a time when knowing yourself, your audience, and your competency pays off, said Richtsmeier. He posed questions under the heading of “know your competency” that speak to what you should communicate. He asked what relevant knowledge you have that “can alleviate one or more of the five factors of trauma.” This translates into how you can achieve one of the following goals (also shown in the image below):

- Reduce uncertainty

- Minimize losses

- Mitigate risk

- Create connection

- Inspire confidence

Posted with permission from CultureCraft. View the webinar at https://www.culturecraftagency.com/crisisbranding.

Crisis advice for financial advisors

Many financial advisors say to “do nothing” at a time like this, and that’s a problem, Richtsmeier said.

I struggled with that statement because “stay the course” is the classic investment advice during a crisis. After all, most advisors aim to position client portfolios so they can weather market declines. They also allocate portfolios in light of clients’ short-term cash flow needs.

I asked Richtsmeier, what can advisors do? He said that some use techniques that actively seek opportunities in uncertain times. They can communicate that information. Later, he shared a LinkedIn post linking to an audio clip recorded by Patti Brennan of Key Financial as an example of a good communication.

If financial advisors are not going to buy or sell client investments right away, perhaps they should mention tax-loss harvesting, a topic that came up in Brennan’s audio clip. Or, they might talk about how clients can manage a crisis-related unexpected loss of income. For example, clients might take advantage of a home equity line of credit, defer a planned IRA contribution, or do something else that they can discuss with their advisor. (Please don’t look to me for cash flow advice. I’d ask my advisor for advice in this situation.)

Another Richtsmeier suggestion for advisors was to schedule more meetings—not in-person meetings, of course. And, to make those meetings more about asking questions than delivering answers. That squared with other advice for advisors that I discuss below.

More perspectives on advisor-client communications

As Steve Wershing said in a recent blog post on The Client Driven Practice, “How you act now has a big effect on client loyalty. The guidance you provide during difficult times is more valuable (and more appreciated) than what you do during good times.”

Here’s one of his tips:

Ask, don’t tell. It is unproductive to tell people how they should feel. Like dealing with an angry child or a despondent widower, trying to talk them out of their feelings may not be helpful. Their feelings are what they are. Instead, ask them what’s on their mind. Permit them to talk it out.

In his blog post, Wershing referred to a post on “What Your Clients Really Need Right Now” by Julie Littlechild of Absolute Engagement. She suggested staying away from conversations about why everything will turn out all right. She also said not to ask clients how they feel about the current crisis. That’s because it’s obvious how they’re feeling.

Littlechild said:

Wouldn’t it be better to help clients articulate how they’re feeling about the future [instead of about the current crisis] and then use that input to start a different conversation? You can do that through one-on-one discussions, an informal poll or as part of a more structured client feedback process.

She suggested asking three questions:

- Confidence: How confident are you that you will reach your primary financial goals?

- Control: How confident do you feel that you can positively impact your own financial future?

- Clarity: How clear are you about your plans for retirement?

These questions could be quite powerful in directing clients’ attention to their long-range goals instead of short-term turbulence.

Advisors can also check out a video discussion between Littlechild and Bob Veres of Inside Information. Veres says it’s important to acknowledge clients’ fears as the “lizard brain” kicks in.

On a related note, advisors should be ready for a shift in one-on-one interactions with clients. In a press release aimed at marketers, research group Gartner said, “Externally, marketing organizations should be ready for rapid changes toward at-home and digital delivery of products and services.” I imagine this may accelerate the trend toward remote meetings via video or screensharing.

Your suggestions for financial crisis communications?

If you have suggestions on client communications during a crisis (or if you’ve read a great article on the topic), please let me know. I always enjoy learning from you.

Relevant posts from various sources

- Peter Atwater on Effective Conversations with Underconfident Clients—There’s a transcript below the podcast, if you’re an impatient listener like me.

- 10 Ways to Communicate with Empathy and Authority in Times of Crisis

- Writing sensitively about tragedy in your investment commentary or blog