Investment commentary–5 ways to outsource

Market and portfolio performance commentary is an important part of communications strategy for most investment and wealth managers. But sometimes writing that commentary becomes a drag on the firm’s employees. Or perhaps the firm realizes that its employees are better at strategy and portfolio management than writing. If this describes your firm, it may be time for you to outsource your investment commentary.

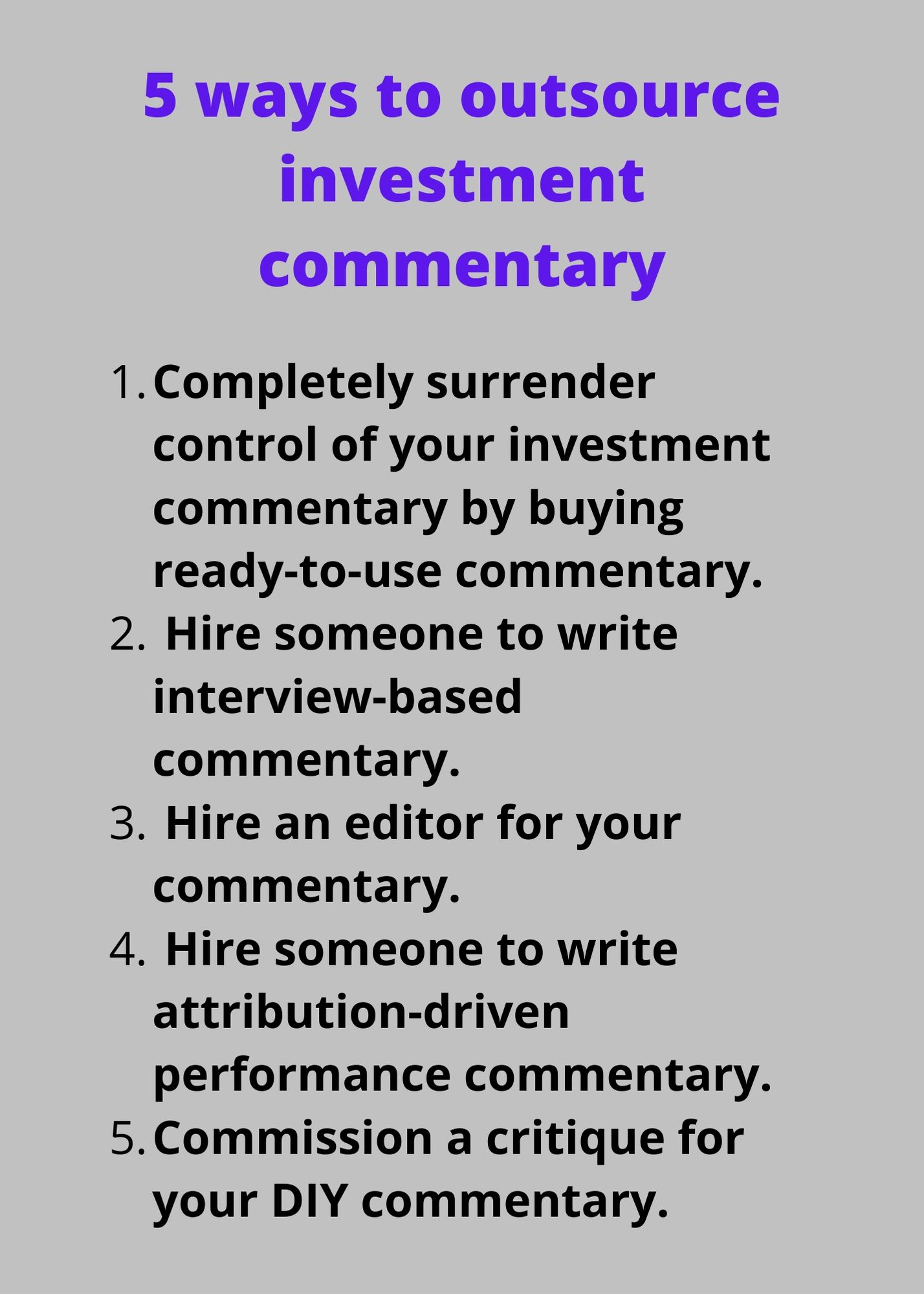

I see five main models for commentary outsourcing, depending on the kind of commentary you need. These vary in terms of how much control you give up over the content and the process.

Option 1: Completely surrender control of your investment commentary

If investing isn’t a core part of your firm’s expertise, you may not feel the need to express insights specific to your firm or your portfolios. In this case, you can simply buy ready-to-use commentary or commission a trusted financial writer to create the market recap and outlook that goes to your clients.

Buying commentary from a provider who sells the same text to multiple clients is likely to be easy on your budget.

Alternatively, there are writers—not me—who specialize in writing marketing commentary based on their own research. Both the content providers and the writers may allow you to customize their content. Before you edit or slap your name on their content, check the terms of your agreement with the provider.

Option 2: Hire someone to write interview-based market commentary

When you have distinctive, well developed views and the evidence to back them up, then this is a good option for you. Firms that struggle to find time to generate commentary also find this helpful, in my experience.

To ease your quarterly crunch, schedule your interview prior to the quarter’s end. I usually suggest seven to 10 days prior, so you have a good sense of how the quarter is shaping up.

Involve your key decision-makers in the interview. Sometimes that means only your investment strategist. Other times that may mean your investment policy committee, or one person who’s an expert on stocks and another who’s an expert on bonds. A good interviewer will give you questions to mull over prior to your call. This will help to find your commentary’s focus.

Here are some sample questions for your interviewer:

- What is the most important message you want readers to take away from your commentary?

- How did your clients’ portfolios perform relative to the market—and why?

- What factors most influenced the market during the period? Do you expect their influence to continue?

- Are there a few statistics that you’d like to highlight?

- How have you adjusted your portfolios during the period under discussion and do you anticipate more changes?

Above all, it’s helpful to focus on how the information in your commentary affects your clients’ portfolios. After all, that’s their biggest concern.

After the interview, your writer will digest the information to create an outline or draft for your review. She will highlight questions or data gaps that she’d like you to fill. Then it’s your turn to provide the missing information and give feedback.

If multiple people give feedback, I suggest that you consolidate it in one document, with Microsoft Word’s “Track Changes” turned on. “Track Changes” will help your writer identify text to be proofed for grammar and related issues. If two of the evaluators disagree on a substantive issue, please reconcile your views before you forward your document to the writer.

What if significant new data comes in between the time of your interview and when you’re giving feedback to your writer? I ran into that with congressional negotiations over the sequester in 2012. One option is to discuss potential scenarios at the time of your interview, so your writer is prepared. Another option is to jot down your take on the news as part of your feedback to the writer, who can smooth out the words to make them more compelling, clear, and concise. Another possibility is to request a brief update call with your writer. Prior to that call, it’s helpful if you can send her some bullet points with your take on the news, so she can focus her questions to make the most efficient use of your time.

This interview-driven approach isn’t right for everyone. If your commentary typically changes significantly between the first and final drafts—or if it relies heavily on data that comes in late—you’re more likely to find option 3 more helpful.

Option 3: Hire an editor for your commentary

For investment professionals at some firms, putting their ideas into writing is a useful exercise. It helps them to discover their opinions and collect the supporting evidence. This is a form of writing to learn, as writing expert William Zinsser discusses in his book, Writing to Learn: How to Write – and Think – Clearly About Any Subject at All.

However, the folks who generate this commentary become so engrossed in the details that they may find it difficult to edit themselves. It’s hard to get distance from material when you’re immersed in it. Plus, a financial education usually doesn’t include intensive training in copyediting or in understanding the reader’s perspective.

One of the most valuable things that an editor can do is to reframe and reorganize the flow of your information. For example, she can expand on the WIIFM—“What’s in it for me”—of the content. She can also improve logical flow of the piece, and apply my first-sentence-check test.

Other valuable functions that your editor can perform include adding informative headings, streamlining text, and checking grammar and punctuation issues. Headings make it easier for skimmers to absorb your opinions and perhaps even be drawn into the details of your commentary. Sentences that average 14 to 22 words and lack distracting errors also help with reader comprehension and retention.

Option 4: Hire a writer for attribution-driven performance commentary

In contrast with market commentary, attribution-driven performance commentary is specific to your firm’s funds or portfolios. Mutual funds’ annual and semiannual reports also fall into this category.

The components of this commentary may include:

- Your portfolio’s returns versus the benchmarks for the relevant periods

- Attribution analysis—for stock funds, this would include the impact of sector allocations, stock selection, and possibly the cash position

- Discussion of specific holdings that contributed to or detracted from performance relative to the benchmark

- Optional: market commentary, transactions during the relevant period, and investment strategy

Some companies provide all of the necessary data directly to their writer, while others incorporate research or portfolio manager interviews conducted by the writer.

Option 5: Commissioning a critique for the DIY commentary writer

Some firms can boost the quality of their commentary simply by implementing suggestions they receive from a one-time critique of their writing. A writer-editor who’s familiar with commentaries can identify your commentary’s strengths and weaknesses, and provide guidelines for improvements.

What’s next for you?

If you’re rethinking your firm’s approach to your commentaries, contact me to learn how I can help.