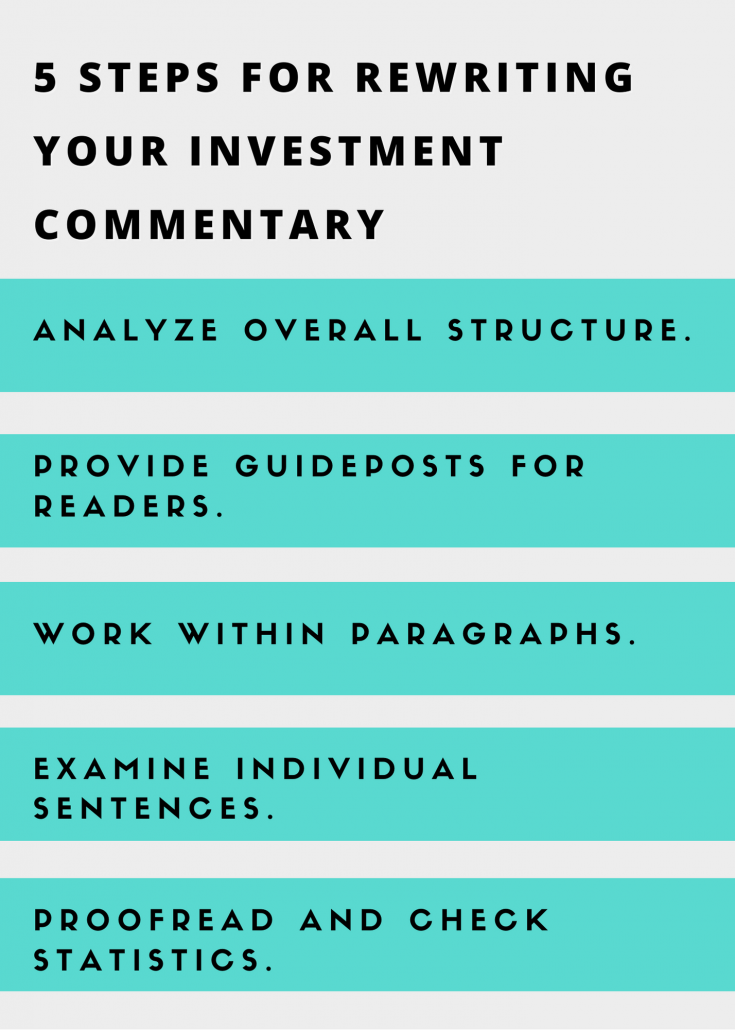

5 steps for rewriting your investment commentary

Investment commentary authors often know the markets well, but lack writing and editing expertise. After all, they’re earning big bucks to manage money, not to write. You don’t want me to run your portfolio, but I’ve learned some lessons about how to edit investment commentary. I’ve edited and written commentary for a diverse group of clients.

My experience has inspired this list of steps for anyone who’d like to edit investment commentary or other articles.

Step 1. Analyze overall structure

Before you dig into the details of your commentary, look at its overall structure. Your analysis may lead you to delete or move entire sections to make the structure more reader-friendly.

First, identify the main themes of your commentary. You may decide after a quick reading that your themes are something like the following:

- This was a volatile quarter, due mainly to disappointing corporate earnings and instability in the Middle East.

- Corporate earnings are likely to recover for three reasons.

- Instability in the Middle East will continue, and here’s how it affects our investing.

- Here’s why these six stocks are the portfolio’s biggest winners or losers for the quarter.

If a simple read-through doesn’t identify your main themes, you can try mind mapping your commentary’s content. I sometimes use mapping when editing complex client documents. Mapping gives me a bird’s eye perspective that helps me spot clusters of ideas that form themes. For more on mapping, please see my book Financial Blogging: How to Write Powerful Posts That Attract Clients.

Once you’ve identified the themes, delete any paragraphs that aren’t relevant. Also, move your paragraphs so your argument builds in a logical order.

Step 2. Provide guideposts for your readers

Once you’ve identified your commentary’s themes, you can make it easy for your readers to absorb them. Three key tools are your title, introduction, and headings. Each of these components should manage your readers’ expectations.

Titles should communicate your main topic. Simply writing “Third Quarter Review” isn’t enough. It doesn’t distinguish this quarter’s review from all that preceded it. Nor does it distinguish your review from those of your competitors. At a minimum, name your main topic in your subject line. For example, “Third Quarter Rocked by Earnings and Middle East Conflict.”

As for your introduction, I believe it should say exactly what you’ll cover. This lets your readers quickly assess whether your commentary interests them.

Next, use your headings as milestones for your commentary. Express your opinion or conclusion, if possible. For example, instead of using “corporate earnings” as your heading, consider something like “corporate earnings disappoint, but rebound likely.”

Step 3. Work within paragraphs

Once you’ve completed your “big picture” edits, dig into your individual paragraphs. Strong topic sentences will ensure that today’s busy readers can skim what you read, using their quick scan to zero in on the content that most interests them.

A strong topic sentence covers the paragraph’s main point. Everything that follows in a specific paragraph should relate to the topic sentence. If not, then cut it. This isn’t the only correct way to write, but it’s the best way to write for online readers and readers suffering from information overload.

For more on this topic, read my blog post about the first-sentence check.

Step 4. Examine your individual sentences

The next step is to make what professionals call “line edits.” This means correcting and improving your sentences for grammar, punctuation, vocabulary choices, and other issues in your writing style.

Working down to small items from “big picture” items is efficient. It means that you don’t waste time improving your word choices in a sentence or paragraph that you ultimately cut from your draft.

Step 5. Proofread and check statistics

Once you’ve completed your editing, it’s time to proofread. I’ve blogged in “5 proofreading tips for quarterly investment reports” about my best proofreading tips. Also, check the accuracy of your statistics, such as index returns. If possible, get someone else to proofread your work. After you’ve lived with a document for a while, it becomes hard to spot errors that would smack you in the face on a first reading.

If you follow these five steps, you’ll attract more readers. That’s your goal, right?

Note: I edited this on Sept. 30, 2022.