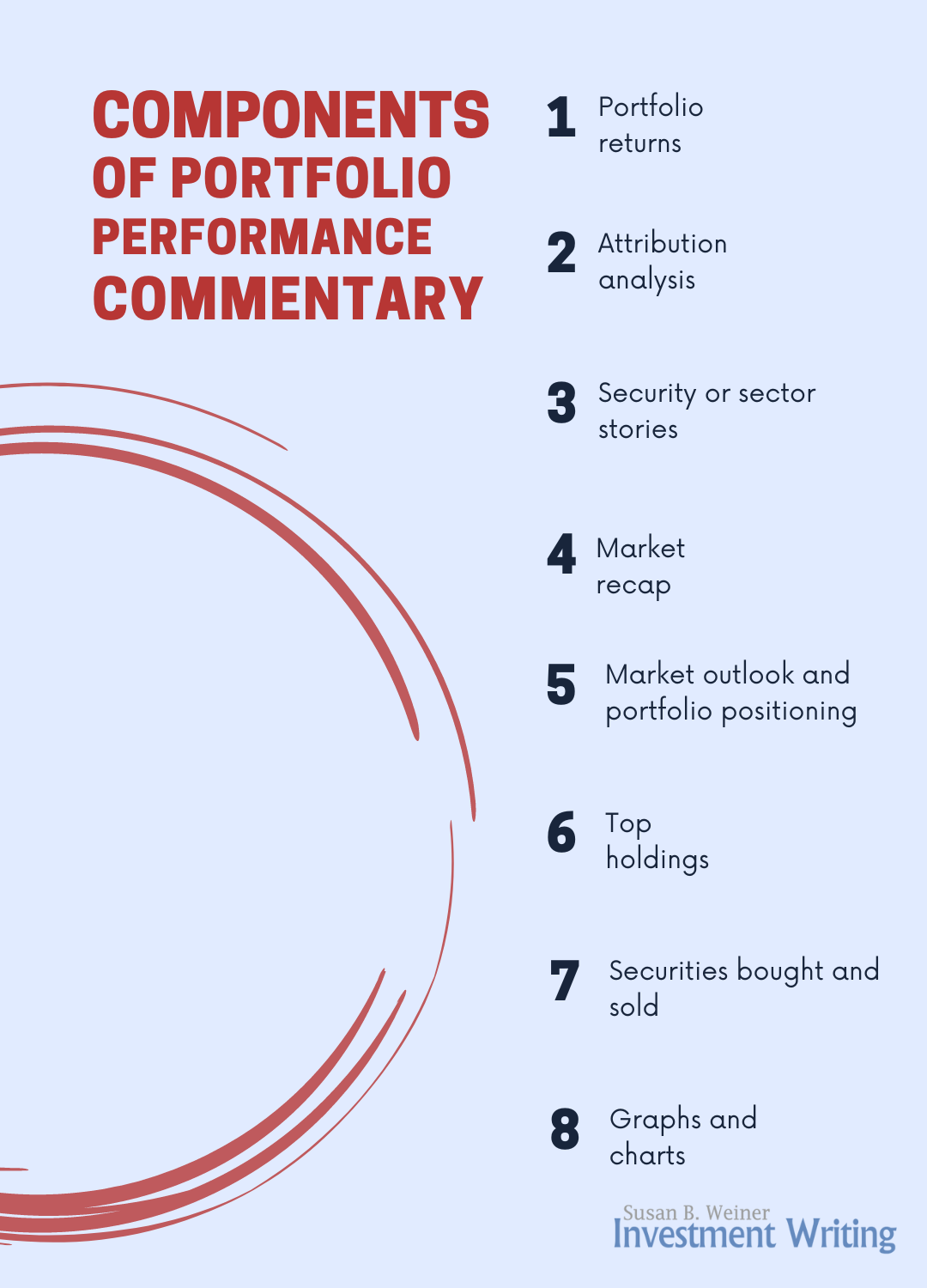

Portfolio performance commentary’s basic components

Commentary about portfolio performance is part of every investment manager’s communications. The depth and breadth of commentary varies widely. It can consist of a single line giving portfolio returns. Or, it can be a multi-page report full of charts, graphs, and details. The longest reports typically target institutional clients—not individuals.

In this article, I review portfolio performance reports’ common components.

1. Portfolio returns

Your portfolio’s results for at least one period are the sole essential element of portfolio performance reports. Portfolio returns are typically compared with the returns of one or more benchmarks to provide perspective on how the portfolio performed relative to its goals, investable universe, or peers. For mutual funds or ETFs, the main benchmark is specified in its prospectus. For separately managed accounts, the benchmark may be specified in the investment policy statement.

Showing multiple benchmarks can provide perspective on performance. Say, for example, you run a small-cap stock fund in the space between growth and blend. Showing returns for the Russell 3000 Growth and for the plain-vanilla Russell 3000 indexes helps readers to understand the extent to which your portfolio’s less growth-oriented approach affected its performance.

Comparing your portfolios performance to its peers—say, Lipper Small-Cap Growth Funds if you run a mutual fund or its decile ranking in an applicable universe of institutional funds—also gives perspective. These comparisons may be more favorable than comparisons to indexes because these returns are measured net of expenses, unlike index returns, which have no expenses deducted. Peer groups may offer a more “real world” perspective on what managers can achieve.

Once you pick indexes for comparison, you must stick with them. You can’t decide, “we look good vs. Lipper this quarter, but bad vs. the S & P 500, so let’s only use Lipper this quarter.” The SEC doesn’t like that.

Similarly, you must be consistent in the periods of performance that you show. It’s a good idea to show more than one quarter of performance. You don’t want your clients to fixate on short-term performance. But once you start to show one-year, three-year, and since-inception returns, you must continue to show them.

2. Attribution analysis

Can you attribute the portfolio’s performance to specific characteristics? That’s the question that attribution analysis seeks to answer.

Attribution analysis is typically measured by numbers, typically percentages. For example, “2.5% of the overall return came from stocks in the financials sector.”

Attribution may be considered relative to a benchmark or independently of benchmarks. When it’s measured relative to a benchmark, a key question is: Why did the portfolio outperform, underperform, or perform in line with the benchmark? You’ll look at factors such as the contributions of security selection, sector weightings, asset allocation, and maybe even cash positions and the flows of money into and out of the portfolio.

You can try to discuss portfolio performance independently of benchmarks. However, you may need to break with that policy if your performance dramatically diverges from the benchmark. This is especially true when you underperform. Your benchmark-savvy clients will want to know why you underperformed.

Numbers don’t tell the entire story of what drove performance. That’s why, at a minimum, someone directly involved in managing a portfolio should review its attribution commentary before publication.

3. Stock or sector stories

Stories about specific securities or sectors can shed light on how active managers think. Stories about winners—and losers—show what the fund managers emphasize in their decisions. Discussions of winners typically show off the managers’ strengths. They also display the managers’ understanding of the larger environment for investments. For example, they may speak to themes, such as beneficiaries of lower commodity prices, that the managers favor. They may also reflect the managers’ market outlooks.

Stories can also illuminate the performance of index funds, to the extent that they demonstrate how the market moves.

To keep the SEC happy, you can’t focus solely on winners, especially if your portfolio underperformed. You must balance your discussion—typically by discussing at least an equal number of losers, although you may have some leeway in a period when losers are hard to find.

Losers pose an extra challenge to writers. Should you defend your holding, in addition to explaining its performance? I like the consistency of keeping the format the same for both winners and losers. Plus, if you’re confined by tight word count limits, you can’t fully explain and defend the losers.

However, defensive comments help if you’re writing commentary for use by your firm’s client service team. They’ll thank you for making their job easier when clients question your holdings. Still, if you don’t explicitly defend your losers, you can provide some context for their performance in your market recap or market outlook sections.

For more on how to discuss underperformance, see “Four lessons from Wasatch Funds on reporting underperformance.”

4. Market recap

A market recap discusses recent market performance. It may focus narrowly on the portfolio’s asset class or it may range more broadly to provide context.

For example, a market recap for a U.S. high yield bond fund might discuss Treasuries, investment-grade bonds, and riskier bonds to show how investors’ attitudes toward risk factored into the portfolio’s performance.

The goal of a market recap is to provide context for the portfolio’s performance. It may also provide insights into how the manager views markets.

5. Market outlook and portfolio positioning

Providing insights into the market’s future is the focus of the market outlook. Managers vary in their willingness to make predictions. Passive—also known as “evidence-based”—investment managers may shun predictions. However, for active managers, predictions help their investors to understand their portfolio positioning.

Comments on portfolio positioning complement market outlooks to the extent that the managers’ allocations to securities, sectors, and asset classes are driven by their market predictions. Of course, other factors affect positioning, such as the managers’ perception of long-term trends outside the markets—so-called secular themes—that will influence the performance of investments.

6. Top 10 holdings

Top 10 (or top five) holdings is a popular section on mutual fund fact sheets for the clues it offers into a fund’s composition, particularly when compared with its benchmark.

If you present to institutional clients, who tend to crave more detail than individual investors, you may write a brief description of your top holdings and why they’re in your portfolio.

7. Securities bought and sold

An asset manager’s buy-sell philosophy is important to investors as they evaluate placing their money with manager. Naturally, once they’re invested, they’d like to see how the manager implements that buy-sell philosophy.

Discussion of buys and sells isn’t part of every investment commentary. There simply isn’t room in some formats.

If you discuss your trades, don’t focus solely on your winners. As I said earlier, the SEC doesn’t like that. However, you can use objective criteria, such as every quarter discussing the three largest purchases and the three largest sales.

If you have enough room, give your readers a brief description of each company and why you bought or sold.

8. Graphs and charts

Some information is easier to absorb as a table, chart, or graph. Take advantage of these formats to help your readers. I particularly like graphs that show portfolio performance vs. a benchmark.

What did I miss?

Did I cover everything that you see as essential to investment commentary? Please share your opinions and insights.

Note: This article was originally published on Oct. 13, 2015, and updated in June 2018, November 2022, and August 2023.

Susan,

I believe it should be: Performance, attribution, and process. The PM must connect performance to the investment process.

Rob

Rob,

That’s a great point about connecting performance to the process. I think that probably gets integrated into the attribution discussion.

Susan,

Thank you.

Maybe it’s semantics, but I believe that the attribution analysis would discuss investment performance vs. the benchmark (sector bets, geographic bets, and so on). If it is a small-cap value fund, they might mention that this slice of the market is either in favor or out of favor.

The investment process, however, does not change. If the firm rigorously selects securities according to price/book measures, and chooses firms with strong cash flow, then this process should not change. The investment performance may vary, but the process should not.

I say this because at the end of the day the PM is really only accountable for delivering a process. Strictly speaking, they cannot control performance: “Your mileage may vary.”

Therefore I always recommend that they tell the investor how investment performance reflects the process. Unfortunately, most PMs avoid accountability like they’re playing dodgeball.

Rob

Rob,

Thank you for explaining. Do you normally include a statement about process at the end?

I find that some managers include comments about why specific stocks, especially detractors, performed as they did. They may refer to their process in describing why they stick with a specific stock despite underperformance. It’s also common, when discussing sector or country performance to refer to whether the manager is a bottom-up stock selector or makes specific sector or country bets.

Susan

Susan,

I like to see a statement about the investment process since that’s why the investor bought the fund. So if a position did well, it helps to link it back to the investment process (implying that “there’s more where that came from”).

The main reason is to confirm the investor’s decision (or the advisor’s decision) to buy into the fund’s process.

For example, I own the Miller Convertible Bond Fund (MCFAX) because it is run conservatively: It doesn’t overpay for bonds and it doesn’t take too much credit risk. I wrote a long article about this product on Advisor Perspectives last December: http://www.advisorperspectives.com/articles/2014/12/23/convertible-bonds-the-rodney-dangerfield-of-liquid-alts

I get the quarterly updates from the firm, and I wish that they would talk more about their process and how it is playing out in the current market. Are they finding value? Are credit risks rising? Perhaps they could use your services to make their performance commentary more compelling.

Rob

Rob,

That’s a nice piece about MCFAX.

Your questions for the fund are sensible. I wonder if they feel constrained by time, space, or perhaps compliance to avoid discussing the topics you’d like.