Like many other Americans, I started baking sourdough bread during the pandemic. I love the process and the taste. As I’ve baked, I’ve also realized that cooking with a sourdough starter has similarities to blogging.

1. It’s scary to start

I wouldn’t have started baking sourdough if I’d had to create a sourdough starter on my own or shell out money to buy a starter. That’s because I figured there was little likelihood that my bread would turn out well. However, I received my sourdough starter—a fermented mix of flour and water—at no cost through my local Buy Nothing group, so I didn’t have anything to lose by trying it.

Similarly, starting to blog involved uncertainty about whether I’d succeed. When I started blogging, I had no idea that I’d eventually write and share well over 1,000 blog posts.

2. Little investment is required to start

Aside from my free sourdough starter, I had everything else I needed to start baking sourdough bread in my kitchen. I had all of the ingredients—flour, water, and salt. I also had two small Dutch ovens.

You can start blogging on a free platform like WordPress.org. As long as you also have a computer, you can start blogging for free.

3. Great instructions help

The woman who gave me my sourdough starter included two pages of feeding instructions with the starter. I read them religiously when I started. I trusted Google to find me a good bread recipe. I feel grateful that it took me to The Clever Carrot’s “Sourdough Bread: A Beginner’s Guide.” The step-by-step instructions turned out to be foolproof.

I wrote Financial Blogging: How to Write Powerful Posts That Attract Clients to provide step-by-step instructions for generating blog post ideas, organizing your ideas before you write, writing your first draft, and doing big-picture edits and line edits. My readers’ reviews say that I’ve achieved this goal.

4. Starting simply helps

Sourdough baking can get complicated. People buy special baskets called bannetons for shaping the sourdough, they use different techniques for giving structure to the dough, they coat the sourdough surface in rice flour so elaborate patterns that they cut in the bread’s surface will stand out, they create parchment paper slings to drop their dough into preheated Dutch ovens that’ll burn you if you accidentally brush against them, and they aim to create an “ear” that makes a slice of the bread look like a side view of a bunny rabbit with a long floppy ear. I haven’t done any of that fancy stuff yet. I might never have started sourdough if I’d thought all of that fuss was necessary.

Blogging can get complicated, too. You can go for elaborate graphics as illustrations, delve deeply into the best SEO keywords and how to implement them, and much more. Those techniques can pay off eventually, but they’re not necessary to get started.

5. Good tools help

Measuring your sourdough using a scale instead of measuring cups helps because the 500 grams of flour add up to a different number of cups depending on various factors. I quickly upgraded to a digital kitchen scale from my manual scale. I also benefited from buying an instant-read food thermometer to check the inner temperature of my loaves so I can confirm they’re not under- or over-baked.

For blogging—or any kind of writing—I find mind mapping incredibly helpful at the idea generation, organization, and analysis stages of writing and editing. I’m also a fan of automated tools, such as PerfectIt (subscription required) and Grammarly (free version available). Folks who care a lot about search engine optimization may benefit from tools like Yoast or Wordstream’s free keyword tool.

6. There’s a role for discard

The process of nurturing a sourdough starter means that most bakers generate more starter than they can maintain or bake, so it becomes “discard.” That’s why there’s a whole category of recipes for this flour-water mix, including this great collection of sourdough discard recipes from King Arthur Flour. I’ve regularly been making a double batch of the sourdough pizza crust recipe since I discovered it early this spring. My second favorite recipe is for sourdough popovers.

Discards from your blog posts can also turn into something useful, as I discussed in “Save your trash to feed your blog.”

7. There are many variations on the basic recipe

I’ve experimented with many variations on the basic sourdough recipe. I’ve used different kinds of flour, seeds, dried fruit, herbs, spices, and even vegetables and cheese.

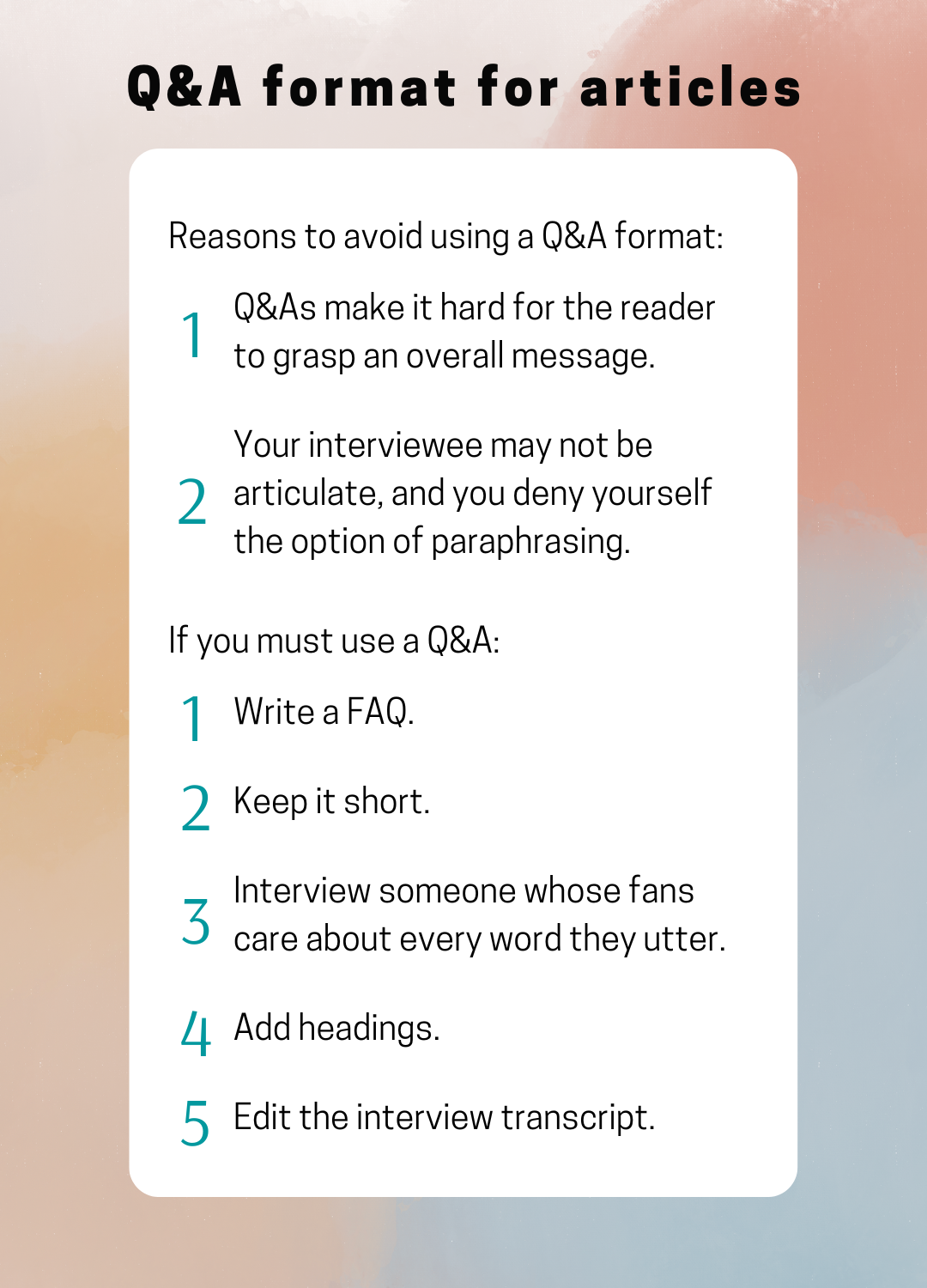

Similarly, there are many different formats for blog posts and different ways to approach a topic.

8. Even failures can be tasty

I have yet to bake an outright failure. However, my friend June tells me that it’s easy to turn a failed bread into croutons or bread crumbs. Bread pudding is another option.

Similarly, an idea that doesn’t turn into a full-blown blog post may still help you somewhere. For example, it might turn into an example that you include in a client email or an item in a FAQ on your website.

9. There’s always more to learn

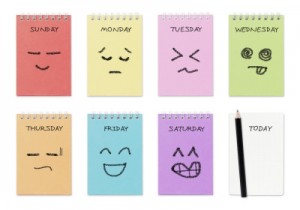

With less than a year of sourdough baking behind me, I still have a lot to learn. I’ve started keeping a sourdough journal where I record the variations that I try and the problems that I encounter. I hope these notes will help me to improve.

I’m still learning about the craft of writing and blogging. Part of the reason I blog is to help me think through the lessons I’ve learned.

Disclosure: If you click on an Amazon link in this post and then buy something, I will receive a small commission. I provide links to books only when I believe they have value for my readers.