ESG opinions can enliven your commentary

ESG investing is hot. More and more individual and institutional investors are considering companies’ strength in terms of their environmental, social, and corporate governance characteristics. This is a topic you might want to discuss in your client communications.

“Which Corporate ESG News Does the Market React To?” (membership required to view complete text) is a 2022 Financial Analysts Journal article that can spark some ideas for your commentary. The article suggests that investors respond to unexpected news and that “investors are motivated by financial rather than nonpecuniary motive as they differentiate in their reactions based on whether the news is likely to affect fundamentals.” Also, “This price reaction is larger for ESG news that is positive, receives more news coverage, and relates to social capital issues relative to natural or human capital issues.”

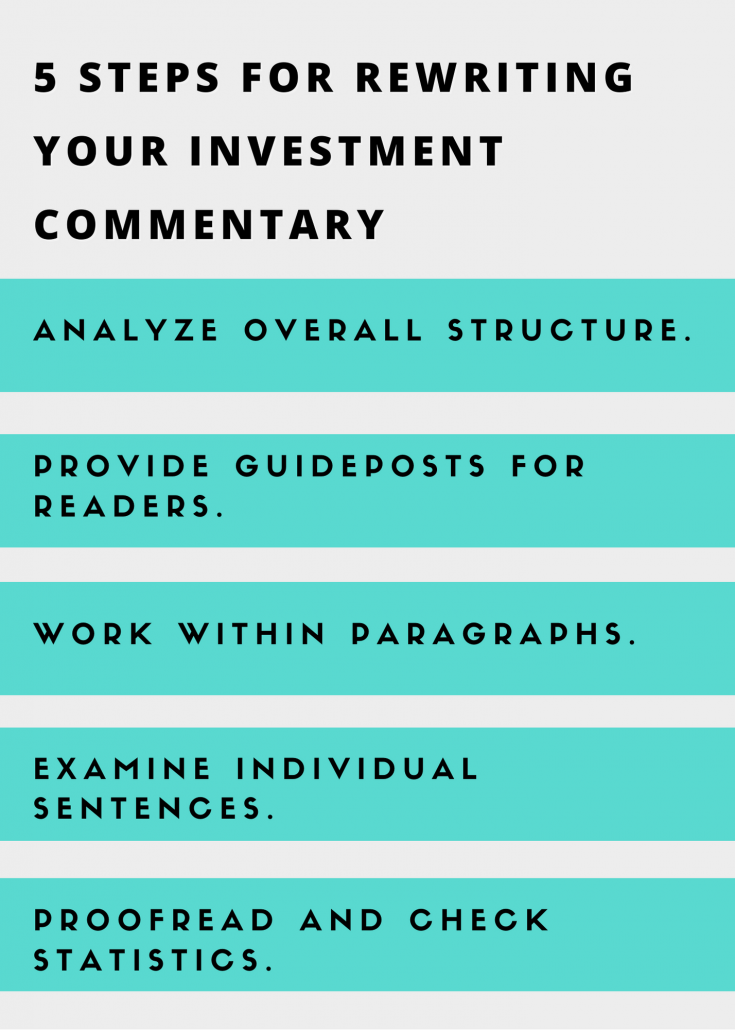

You can start your discussion by using the techniques I originally discussed in “Investment commentary topic: ETF controversy.” (See “3 ways you can use a Financial Analysts Journal article for investment commentary” image below.)

1. Discuss whatever this article makes you think about

You can run with the questions suggested to you by the article. If you have opinions about ESG-related drivers of stock prices, share ’em.

Or, use the article to spur your discussion of ESG-related issues that don’t necessarily relate to stock prices. Perhaps you think it’s far more important to look at the impact of your stock choices on ESG-related corporate activities and social justice than to understand what moves stock prices. It’s helpful for your clients and prospects to know if you think, “Who cares what drives stock prices? We need to save the world.”

2. Discuss why the article is right about ESG investing

You can go deeper than the article, or you can explain how it applies to the investments your firm uses.

If you’ve observed the phenomena discussed in the article in specific stocks or industries, that makes for an interesting story that gives insights into your approach to investing. Of course, make sure your firm’s compliance professionals approve (and provide appropriate disclosures) for any discussion of specific stocks. Also, don’t cherry-pick only positive examples of your firm’s analysis (or use appropriate disclosures if you only discuss positive examples).

If your firm invests in funds that are adept at using positive ESG-related news in their stock selection, that’s another good topic for your client communications.

3. Disagree with the article

If you discover flaws in the authors’ arguments, identify those flaws and say why they should matter to your clients.

Your ability to evaluate information critically is important to your clients. That’s especially true when you tie your analysis to its impact on your clients’ WIIFM (what’s in it for me).

Credit your source for this ESG topic

You must credit the Financial Analysts Journal article as your source. That’s especially true if you cite data from it. But mention it even if it was merely the article title that sparked your ideas. Your clients and prospects like to know that you read reputable sources of research to stay up on investing.