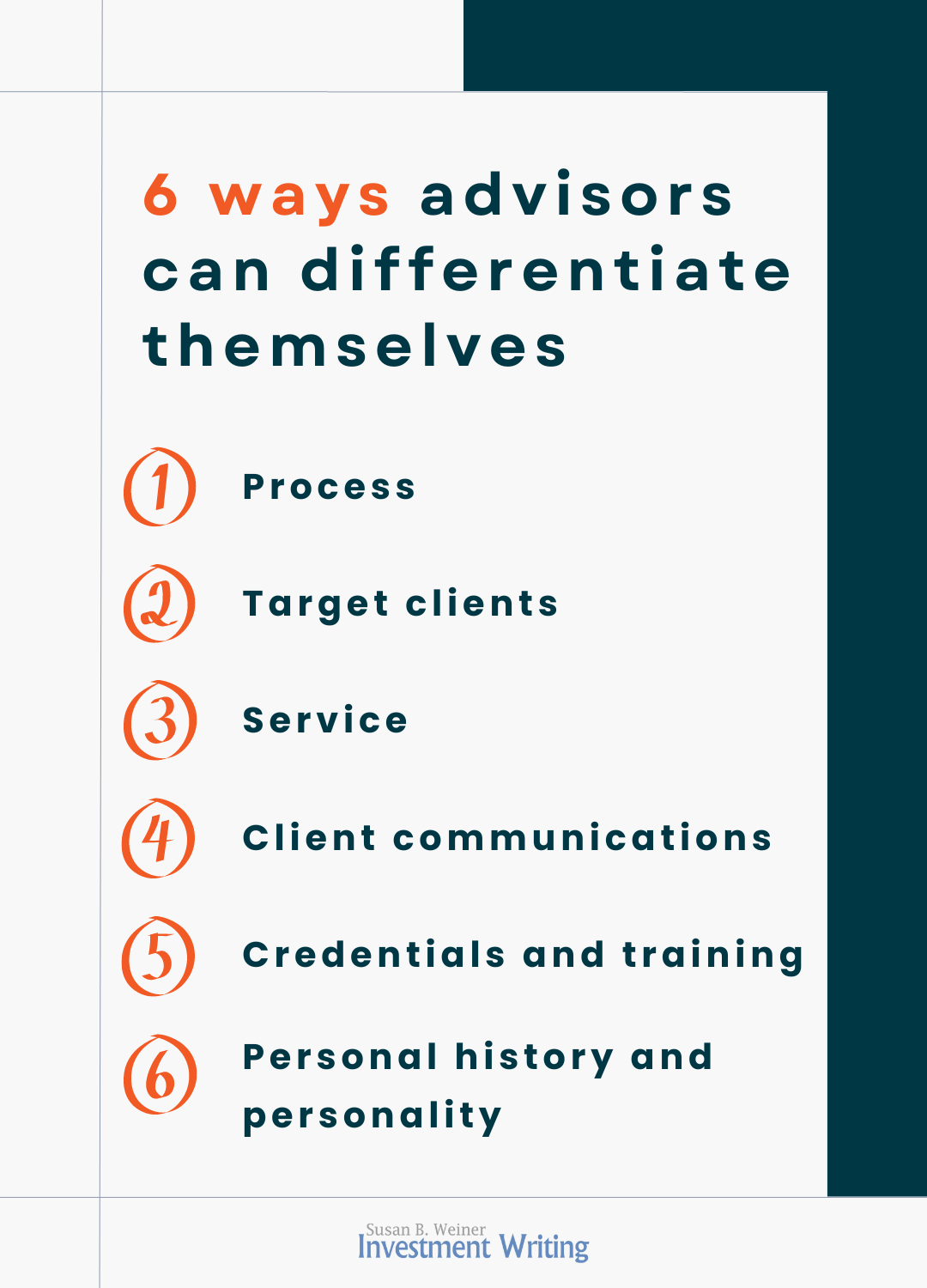

6 ways financial advisors can differentiate themselves

It’s difficult for financial advisors to differentiate themselves. Whether you’re a financial planner, wealth manager, or investment advisor, what you offer has a lot in common with your peers’ offerings. Saying that your service and offerings are exceptional won’t convince prospects of that fact. Advantages that might have set you apart 10 years ago, no longer work. You must dig deeper.

How can you stand out? Ask yourself the questions below to start your research.

1. Process

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

Differentiation questions:

- What is your process? How do you assess clients’ needs and desires?

- In your process, do you ask questions that drive home how you help clients? For example, you may ask an unconventional question about clients’ values, goals, or worries.

- What concern for clients drives your process? Are you passionate about something specific?

- How does your process allow you to deliver what your clients need?

- What results has this process achieved for your clients? In other words, what problems does your process solve for clients?

- Do you manage money yourself, use a third-party asset management firm, or avoid dealing with investments? If you invest, do you use funds, standard portfolios, or do you customize?

- Do you have access to products or services that are difficult to access?

2. Target clients

You can’t serve all types of clients equally well. Also, an advisor who tries to attract all clients, connects deeply with none. Specialization is essential.

Advisors slice their target audiences in many ways. For example, level of wealth, age, financial goal, industry, or employer. When you’re focused, your prospects will feel more comfort that they’re with the right advisor.

If you’ve been in business awhile, consider conducting a survey about why your clients like doing business with you. You could do this informally, by asking questions in meetings. You might get more honest answers if you ask in an impersonal way. For example, you could run an anonymous online survey using a tool such as SurveyMonkey or you could hire a marketing firm to interview your clients.

Differentiation questions:

- What kind of clients do you focus on? Who do you avoid?

- Why do you feel passionately about your target group?

- What client problems are you most successful in solving? The answer to this question matters a lot to your clients and prospects.

- What kind of successes have you achieved with clients in your target audience? By the way, consider sharing case studies to illustrate successes, if your compliance officers allow them.

3. Service

You can’t simply say “We offer great service.” Back up your statement with specifics.

Differentiation questions:

- How accessible are you to clients? Must they wait a week or longer for a response from you, or are you more accessible?

- Do you spell out your commitment to clients in a service-level agreement?

- Do you make it easy for your clients to hold up their end of the relationship by providing a written summary of key decisions and their next steps after your meetings?

4. Client communications

How do you communicate with your clients? At one extreme, do you figure that your clients’ statements from their custodians give them all the information they need? That’s not enough for many clients. Plus, it gives you no chance to show your expertise and concern for your clients.

At another extreme, do you call clients whenever the market is volatile, post updates on your blog, send regular newsletters, and schedule quarterly face-to-face meetings? If you focus on your individual clients’ concerns, tailoring your content to their needs, they will feel your concern and see your expertise. On the other hand, some clients may feel suffocated. When I worked on staff for an asset management firm, we had clients who essentially said, “Don’t bother me for more than an annual meeting.”

Differentiation questions:

- What communications do you provide?

- Are your communications segmented to appeal to your clients’ needs and personalities?

- How frequent are your communications?

- What media do you use to communicate—print, email, online, phone, text, social media?

- What’s your communication style? For example, do you present yourself as an authority who must be obeyed or are you more of a collaborator?

- Are your communications written in a way that’s compelling, clear, and concise—or will your clients struggle to figure out what the heck you mean?

5. Credentials and training

Your education counts. Academic and on-the-job training enable you to help clients make progress on their financial goals. Of course, as others have said, basic training is the price of admission to this industry.

Differentiation questions:

- What’s your academic training?

- What credentials do you hold? What do they mean for your clients? The average person on the street has no idea, for example, what the CFA credential stands for.

- Do you invest in ongoing professional development?

- What are your specialties, if any?

6. Personal history and personality

Nobody has the same personality or history as you. Capitalize on this by being yourself as you market your firm. I like what advisor Tim Maurer says about selling his golf clubs in “Financial Advisors: Differentiate Yourself By Being Yourself“:

It signaled an official decision to permit myself to be something other than what I had come to believe the financial industry wanted me to be. I was officially granting myself permission to be myself.

Since making that decisions, Maurer has followed his instincts in other ways. It seems to have worked well for him.

Differentiation questions:

- Why are you in this business? Did a personal experience inspire you?

- What are you passionate about?

- What are your hobbies, and what do they say about you?

- What are your strongly held values?

- Are you active in your community?

Image courtesy of Sira Anamwong/FreeDigitalPhotos.net