Planning to run your first live webinar? It’s a great way to attract prospects and deepen relationships with clients of your investment, wealth management, or financial planning firm. I watched a bunch of live webinars as I planned to relaunch my financial blogging class. Some of them were painful to watch. These webinars got me thinking about what distinguishes the best from those that seem less professional. I compiled a list of mistakes to avoid in your first live webinar.

Live webinar mistake 1. Not practicing before you deliver the real thing

You know the saying, “Practice makes perfect”? It may not make perfect, but it helps you to avoid problems that you could have anticipated. I participated in a live webinar where the host was surprised to discover “Oops, the webinar software won’t let me do that.”

If you practice enough times in advance, you’ll get a sense of what can go wrong. For example, during a live presentation of my investment commentary webinar, I accidentally touched the cursor to the wrong spot and popped out of slide presentation mode. This had happened during my practice sessions so I knew exactly how to get back to the right place. Of course, it’s impossible to anticipate everything. Your viewers will forgive you if you’re reasonably good at using your software.

Live webinar mistake 2. Not logging in or acknowledging participants by the official start time

Imagine that you’re a participant who shows up on time for a webinar. The designated start time comes and goes without any word from the presenter. You start to wonder if you’re there on the right day. You feel anxious and maybe a little angry at the organizer’s lack of respect for your time.

When you’re the presenter, you should log in early. You don’t need to start your call early, but it’s nice if you make people aware that you’re there and that you will start at the designated time. On my webinars, my facilitator starts checking in with participants as much as 30 minutes early. This courtesy is particularly important when people pay to participate in your webinar.

Live webinar mistake 3. Not having an agenda

When you don’t manage people’s expectations, they’re often disappointed. Sharing an agenda at the beginning of your presentation helps. People look at the agenda and can decide, “Yes, this is what I want” or “No, this webinar isn’t for me.” Turning away people who aren’t a good fit can be valuable.

Touch upon your agenda in your webinar’s marketing materials. This could include your online sales page, emails, and other communications.

An agenda will also help to keep you on track by providing a road map for meeting the commitments you’ve made to your audience.

Consider offering a handout that includes your agenda and other aids to note-taking. I don’t believe in sharing slides—especially not ahead of time—because they’ll distract people from your presentation. My handouts include headings for each major section of my presentation. I often include the text of the “before” versions of my many before-and-after writing samples.

Live webinar mistake 4. Not having a helper

When you present a live webinar, you need to devote 100 percent of your attention to the presentation. You can’t stop to respond to participant questions about technical problems that are unrelated to your content. That’s not fair to your other participants.

Even answering questions about your content can be a problem, detracting from your ability to connect with participants. Have you ever heard the sound of overwhelmed presenters as they try to scroll through a long list of participant questions, comments, and chitchat entered into a webinar’s chat box? They start talking fast and in a tentative tone of voice. It’s not easy to sort out the legitimate questions from the noise. When you’re anxious about doing that, it’s even harder to answer questions well.

You can make the technical problems and Q&A process easier by recruiting a tech-savvy helper. Your helper can field technical questions behind the scenes. When Q&A starts, ask your helper to sort through the questions and then read them out loud to you. In addition to relieving your stress, the change in voice—from you to your helper—will make it easier for your audience to understand where the question ends and your answer starts. It may even wake up listeners whose attention has wandered.

I wish more webinar presenters hired helpers. My main helper has delivered many webinars herself, which means she understands the technology. She has also seen what can go wrong. Before I present, we run through the entire presentation, including my logging in from a separate computer as a viewer to lob questions at my helper.

Live webinar mistake 5. Expecting people to multi-task for your webinar

I participated in a webinar where the well-meaning speaker expected us to open a second window on our computers and follow her instructions as she spoke. It was a great idea. People absorb lessons better when they apply things as they learn. However, it didn’t work. Instead, participants seemed to get frustrated by the difficulty of understanding and implementing her instructions.

Here are some reasons why expecting participants to work along with you may fail:

- They may not have enough computer power to open a second window on their computers. Webinar software can be a big drain on resources.

- Your content may be too complex for them to absorb and implement based solely on hearing your instructions orally, with no instructions in front of them. This might work better if you send step-by-step instructions in advance for participants’ reference. But if you do that, why should they watch your webinar?

- Your participants may be at different levels of ability to understand and implement your instructions. It’s hard to give instructions that satisfy people at multiple levels.

- Inviting people to do other activities on their computers may make it more likely that they get distracted by other opportunities on their computers, such as checking email or social media. When you tell them to take time away from watching your presentation, you communicate that they won’t miss valuable content from you while they’re not focused on your presentation.

If you want people to take actions during your webinar, keep them simple. Consider providing a handout to make it easier for participants to absorb important instructions. Your handout can incorporate worksheets to help participants plan for later actions.

Live webinar mistake 6. Not providing step-by-step instructions in writing

People have different learning styles, but most will benefit from written instructions when learning a complex process. I felt frustrated when I attended a webinar that attempted to teach me a complex process. It was great that the instructor demonstrated the process. However, I had trouble keeping track of the many variables that went into doing the process correctly for my situation. I’m still confused after watching the webinar replay multiple times. I wish that the instructor had provided written instructions, instead of relying on the live presentation and participants’ ability to access the webinar recording later.

Your written instructions could appear on-screen during the presentation. You can also put them in an outline-style handout or a separate step-by-step instructional handout. Another idea: Have your helper type the instructions into the chat box.

Live webinar mistake 7. Not testing the recording quality in advance

“The words are too small in the recording.” If you don’t test the quality of your recording ahead of time, you could be caught by surprise with a comment like this. It happened to one webinar presenter whom I know. What you see as the presenter (or as a live viewer) isn’t always what comes through in the recording. I don’t know how to explain the technical problem, but in this instance it seemed to be related to the webinar provider’s technology, rather than anything the presenter did.

Do a test recording in advance so you’re not surprised by things that you could have anticipated. Of course, most webinar software is glitchy—at least in my experience—so you may still encounter problems that you couldn’t have foreseen. That has happened to me.

Live webinar mistake 8. Not telling people about replay availability

Some webinar participants like to watch replays. Others start craving a recording when something happens during the webinar to make them miss some of your content. In either case, they’ll approach your webinar in a happier state of mind if it’s clear up front that a replay will be available.

If you’re not sharing a replay—or if the replay will be available for only a limited period of time—announce that, too. It’ll inspire your participants to pay more attention to your live webinar.

Live webinar mistake 9. Not engaging your participants

Ignoring input from your participants means that you miss out on opportunities to boost their satisfaction or to learn from them.

Most webinar software has some sort of Q&A or chat function. Use it.

As I suggested in my discussion of Mistake 4, interaction will go more smoothly when you have a helper to assist in soliciting and responding to participants’ input. But sometimes the participants can do perfectly fine on their own. I’ve participated in a webinar where the chat was visible to all participants. I picked up some great tips from other chat-room participants. They answered some of my questions before the speaker.

When I’ve delivered my webinar on “How to Write Investment Commentary People Will Read,” I’ve learned from the answers people gave to my live polls and when I asked them to type answers to my question into the chat box.

What next?

Avoid these nine live webinar mistakes and you can enjoy more success as you educate your clients, prospects, and referral sources.

I don’t know everything there is to know about live webinars. Please share your tips and suggestions. For more of my webinar-related tips, see “Tech tips for your educational webinar–Learn from my experience.”

Image courtesy of Stuart Miles at FreeDigitalPhotos.net

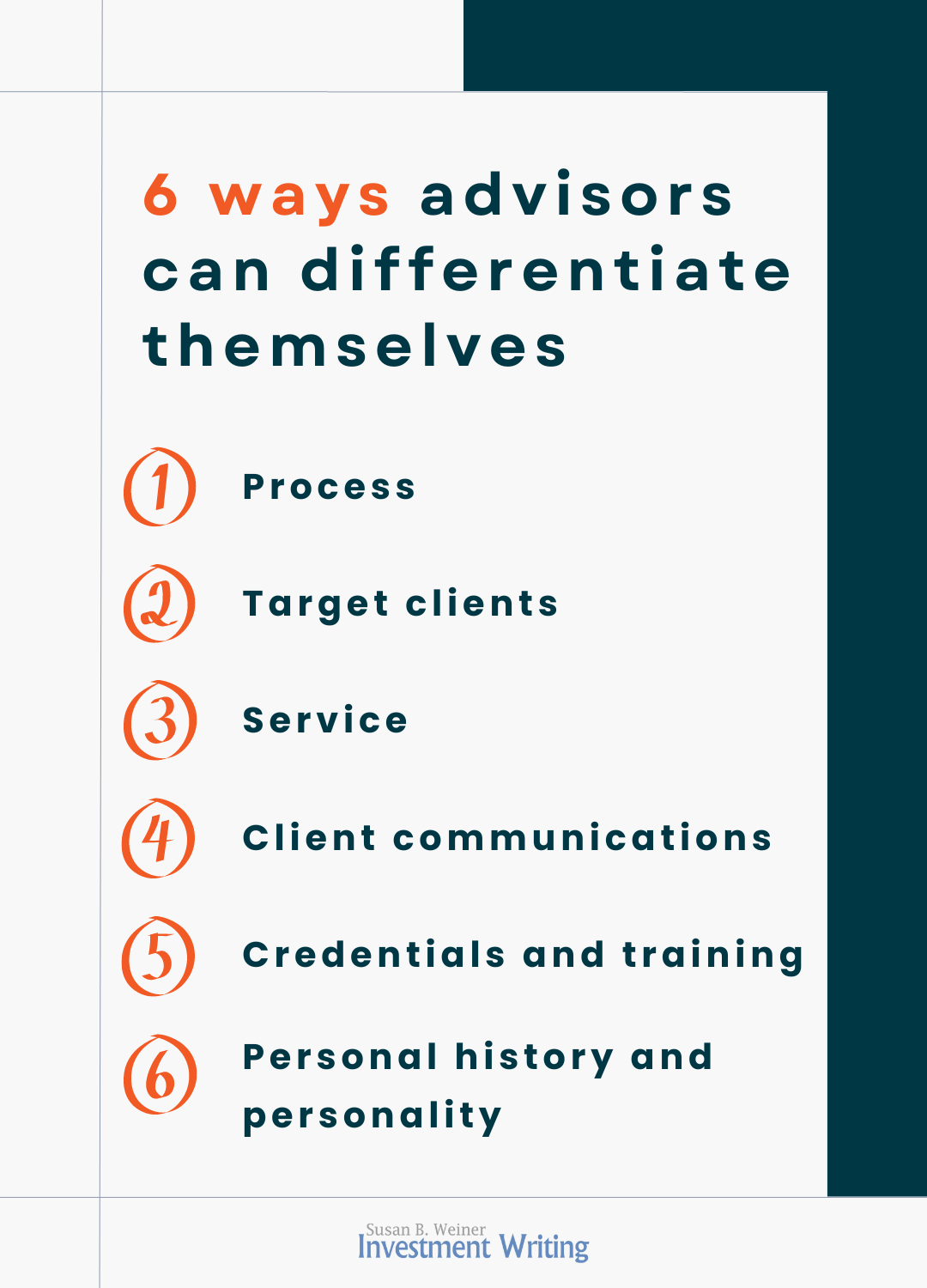

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

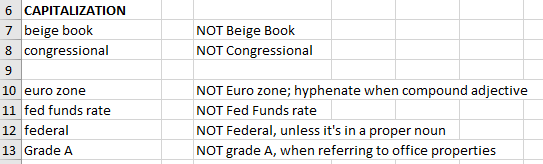

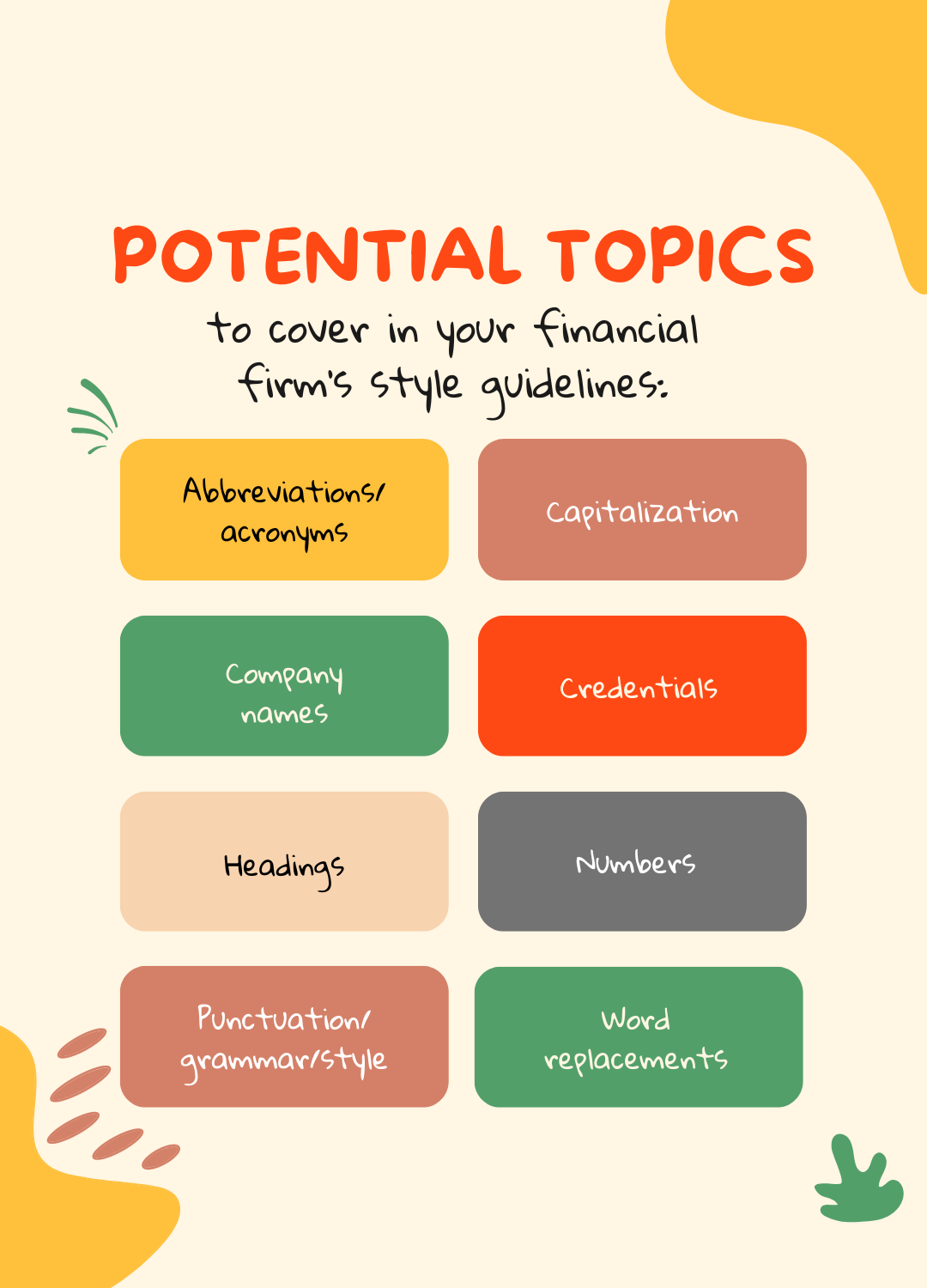

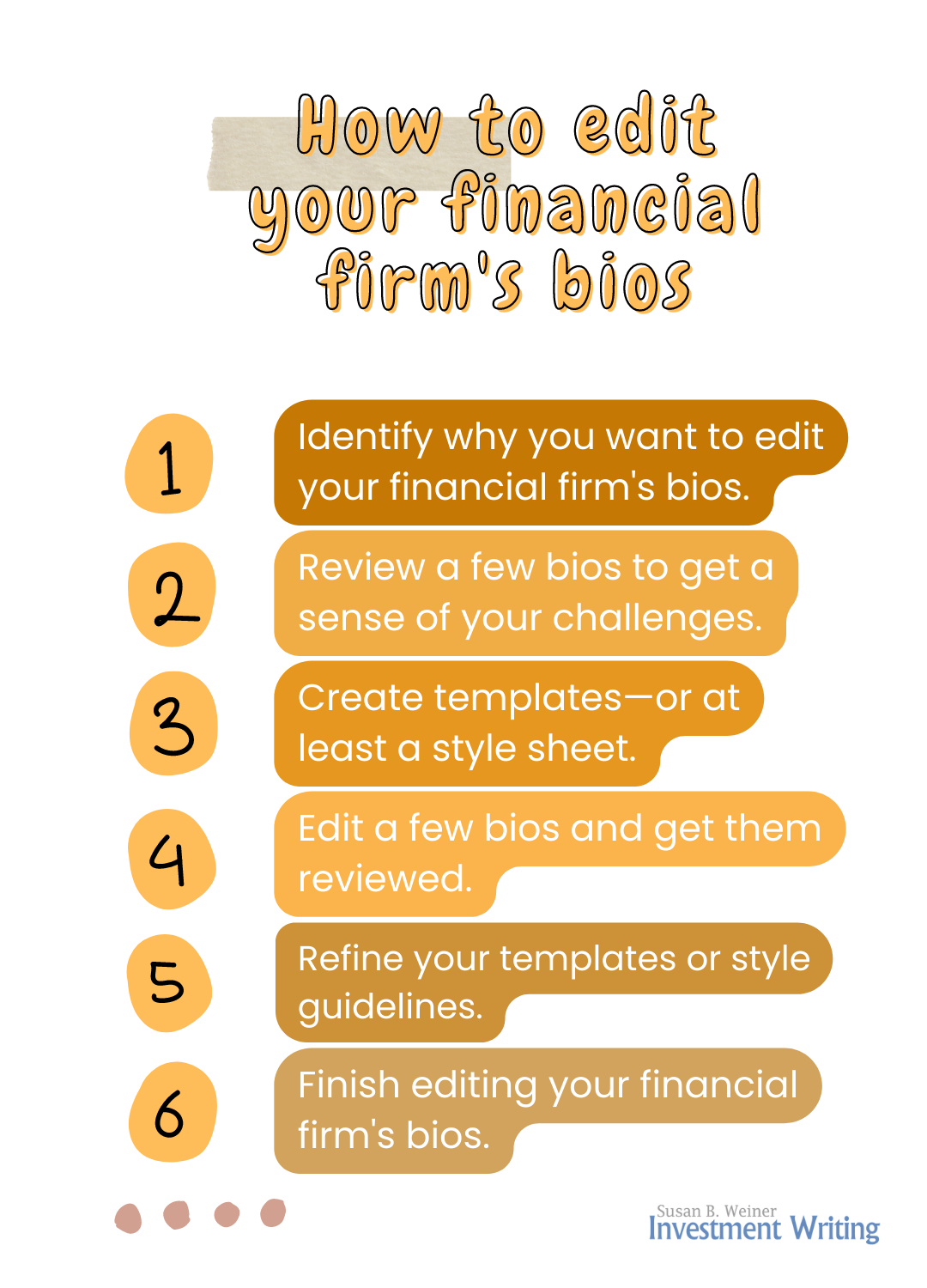

It can be distracting if writing styles are inconsistent within and across documents published by your firm. For example, is it “counterparty” in the first paragraph and “counter party” in paragraphs two and three? Do headings randomly mix sentence case and title case? Is your company name abbreviated in different ways?

It can be distracting if writing styles are inconsistent within and across documents published by your firm. For example, is it “counterparty” in the first paragraph and “counter party” in paragraphs two and three? Do headings randomly mix sentence case and title case? Is your company name abbreviated in different ways?

You can edit better when you know the purpose of your work. At one extreme, are you merely proofreading for big errors so you’re not embarrassed by someone’s title being spelled as “manger” instead of “manager” or are you looking to change the tone and content of your bios?

You can edit better when you know the purpose of your work. At one extreme, are you merely proofreading for big errors so you’re not embarrassed by someone’s title being spelled as “manger” instead of “manager” or are you looking to change the tone and content of your bios?

PDF e-book sales tip 1. Figure out what you want from your provider

PDF e-book sales tip 1. Figure out what you want from your provider