My big newsletter mistake’s lesson for you

When’s the best day and time to send your e-newsletters? My January mistake upset my beliefs about this topic.

My usual routine and its rationale

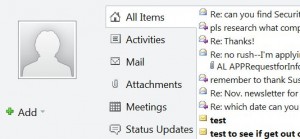

I usually send out my monthly newsletter around 8:15 a.m. on the first non-holiday Tuesday of the month. I send it early in the day because my Constant Contact statistics indicate that many people open it before 9 a.m. I figure they get to work early. I’m happy to make it easy for them to read before they’re distracted by work.

I picked Tuesday because I’ve read that people are distracted on Mondays and Fridays as they start and end their workweeks.

I publish on a consistent schedule because I’ve read that your audience values consistency. They want to rely on receiving your content regularly.

However, I skip holiday Tuesdays because I figure my audience reads me at work. I hope you’re not checking email on holidays.

My mistake: Sunday delivery

I made my mistake in haste after proofreading my letter the Sunday before my usual Tuesday in January 2013. I forgot to schedule my newsletter instead of letting it default to sending immediately.

Oh horror! I imagined my newsletter languishing unopened in hundreds of email inboxes. I was extra mad at myself because this newsletter was most of my subscribers’ last reminder about registering for my blogging class. I probably cursed out loud that afternoon.

The surprising results

But lo and behold! Over the following days, my newsletter hit its usual level of subscribers opening it. I didn’t suffer at all for sending it at the “wrong” time.

What a relief! I don’t need to freak out the next time my newsletter deviates from its usual schedule. However, I plan to return to my usual schedule because it’s good discipline for me.

What’s the point?

My experience convinced me that Scott Stratten, who tweets as @unmarketing, was right when he said in “The best time never to send email” that “The best time to never send email is when someone else told you to” because what matters is what recipients do when they receive your emails.

On the other hand, Michael Katz of Blue Penguin Development may be right that there are bad times, but no best times to send your emails, as he suggested in “Why Today is a Bad Day to Publish Your Newsletter.”

What works for you?

I’m curious about your results from sending e-newsletters at different times. Do some times work better than others for you?