Are you a financial professional, writer, or marketer with questions about whether “How to Write Blog Posts People Will Read: A 5-Lesson Writing Class for Financial Advisors” will work for you?

You’ll find answers to common questions below. Do you have questions I haven’t answered below? Leave them as a comment or call me at 617-969-4509.

Q. Is this a webinar?

A. No, it’s a relatively low-tech approach. Students told me they enjoyed not being tied to their computer during the lecture part of the class. This reinforced my instinct to keep the technology simple.

Q. How are classes taught?

You will download audio files to listen to when it’s convenient for you.

A. Each of the classes consists of a recorded audio file (.mp3 format) and a handout (.pdf or Word file) for you to print or view on-screen, complemented by homework assignments, discussion posted to a private website, and a weekly telephone conference call. You’ll download the files from the private website, and then review the lesson at your convenience. You will post your homework assignment and any questions to the private website. You will receive my feedback through the website.

You’ll use a private discussion forum to access materials and share your homework.

Q. What if I don’t see myself as a “financial advisor”? Can I still take your class?

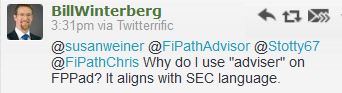

A. I use the term “financial advisor” as shorthand for my target audience, which includes employees of investment, wealth management, and financial planning firms as well as the vendors who support them. You could be a marketer or writer, not just a financial professional.

Q. I can’t commit to a class that meets at a specific time. Will you work around my schedule?

A. I’ve tweaked the class format so you can listen to the class on YOUR schedule, not mine.

- Lessons are prerecorded. This way, you can listen when it’s convenient for you.

- You can post your homework–and receive my individualized feedback–any time between the posting of the lesson and two weeks following the end of the five-lesson series. Students who did their homework and then revised it following my feedback told me that doing the homework–and getting my feedback–was incredibly valuable.

- Class discussion sessions will be recorded and may be downloaded. Listening to a recording isn’t the same as participating “live” but at least you’ll hear your classmates’ questions and comments.

You can save all the audio and handout files to give yourself a refresher course months or even years after your formal training ends.

Q. Why is the class limited to 16 students?

A. You’ll learn more when you get the personal attention that comes with a small class. You’ll have plenty of opportunities to ask questions during our group telephone calls. Plus, you’ll get written feedback on your homework assignments.

Q. Do we get any live interaction with you and other students?

A. Yes, there will be five live conference calls on at least five dates. These calls will focus on your comments and questions. They will be recorded in case you can’t attend “live.”

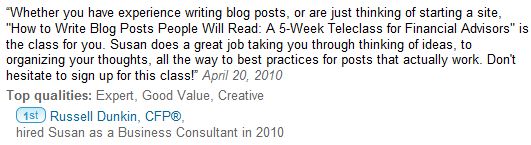

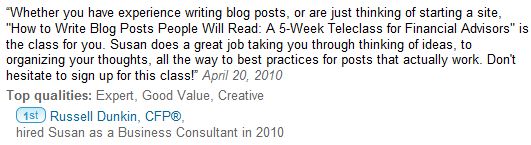

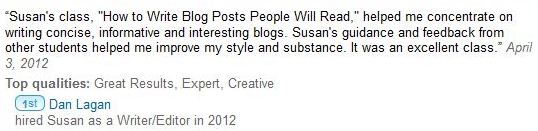

Q. What do students say about your class?

A.

You’ll find more recommendations if you scroll down the registration form for the class.

You’ll find more recommendations if you scroll down the registration form for the class.

Register TODAY to learn a step-by-step process to

- Generate and refine ideas for blog posts that will engage your readers

- Organize your thoughts before you write, so you can write more quickly and effectively

- Edit your writing, so it’s reader-friendly and appealing