Guest post: “Blogging: why you want a better bounce rate”

Website bounce rates puzzle me. So I read guest blogger Tom Mangan’s article with interest. It seems as if you should put the most important information up top, where people will see it. Hmm, that sounds similar to good writing, so it’s not surprising that I met Tom through a community of freelance writers.

Blogging: why you want a better bounce rate

By Tom Mangan

Ever ask yourself where people go when they end up at your website? For most of my blogging life, the answer seemed like “somewhere else, as fast as their fingers can click.” That’s because up until a couple months ago, I ignored a key statistic called “bounce rate” that was telling me my blog needed a healthy tweak.

Bounce rate is one of the key metrics available free from Google Analytics. It tells you how many people visit one page at your blog and bail, typically by clicking the “back” button.

Web traffic gurus know most people make snap decisions about whether your page has something they’re looking for. You’ve got maybe five to 10 seconds to reel them in.

Like way too many blogs, my hiking blog had a standard layout with a header identifying what my site was about, a headline revealing what an individual page is about, and social links like e-mail, Twitter and Facebook. People who came my site had no earthly idea it was brimming with five years worth of content painstakingly compiled to warm a hiker’s heart. Typically over three-quarters of my site’s users left almost immediately; my bounce rate was 75 to 80 percent, day in and day out.

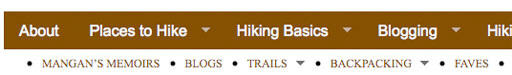

Then I changed to a new WordPress theme that allowed me to install all these cool navigation menus across the top, identifying all the many categories inside my site:

Immediately my bounce rate plunged below 50 percent — roughly a 50 percent improvement.

The game changer: I gave my readers something other than the “Back” button to click in that crucial first five seconds. Now roughly my half of my visitors click a second time. They longer they’re there, the better my chances of making them a regular reader.

If you’re thinking, “well, I’ve got all those links in the rail down the side of my site,” guess what: hardly anybody ever clicks on those. After the top two or three on the list, most get ignored.

Interestingly (or frustratingly, depending on how you look it), the big boost in bounce numbers did not equate, as near as I could tell, to a huge increase in page views. Page views were up, but I had also added new site features, and it was springtime, prime hiking season, when my site’s traffic always rises anyway, so I can’t say conclusively that it helped my raw page count. Furthermore, it appeared that the click-through rate on my Google ads cratered about the same time I made this change, so giving people more click options could be double-edged sword if you earn a living from ad clicks.

But if you use your blog to demonstrate your expertise and connect with potential clients, you’re not fretting over the scraps that land in your Adsense account every couple months. You want to tell people who land at your blog — in that first crucial blink of an eye — that there’s gobs of content inside that they ought to check out if they don’t see anything they want right now. Mind you, site navigation is just one component of your bounce rate. These links explore it in much greater detail.

- Two Simple Rules for Fixing High Bounce Rate Pages

- Reduce Bound Rates: Fight for the Second Click

- Want to improve bounce rate? Six questions you must get right

Tom Mangan is the creator of Two- Heel Drive, a Hiking Blog, and the founder of Verb Nerd Industries, his freelance editing, writing and blogging service.