JUNE NEWSLETTER: Coping with generative AI in articles

Protect your publication against AI-generated text

You need a policy on text created using generative artificial intelligence (AI), such as ChatGPT, if you’re publishing a blog, newsletter, or other communication using articles that you haven’t personally written.

Here’s my policy.

To protect against allegations of plagiarism and copyright infringement, we have a policy on the use of generative artificial intelligence (AI) in preparing articles.

- The writer agrees that all of their work is originally produced and not the product of any AI program, bot, or application.

- Generative AI (such as ChatGPT) may not be used to write stories submitted to us unless the generative AI tool’s use is disclosed and the point of the text is to discuss the use of generative AI.

- Generative AI may not be used to create images for use in stories submitted to us.

- Any use of generative AI must be disclosed.

Forcing AI-generated text to sound more natural

If you must use AI-generated text, please try to make it sound more natural.

One way to do that is to rewrite it yourself. If that’s not an option, consider the tips in “ChatGPT and Tone: Avoid Sounding Like a Robot” on the Nielsen Norman Group blog.

Author Taylor Dykes’ advice:

Including several tone words or an example in the prompt, as well as asking for multiple alternatives, are more likely to produce satisfactory output from AI.

Dykes concludes, “Human brains are still the best tools in the content writer’s tool kit, and they should always look over ChatGPT-generated work.”

AI-generated headshot photos

I was surprised to learn in a neighborhood Facebook group about an AI-driven website that will generate “professional headshots” from selfies or other photos that you provide. Check it out at secta.ai.

You should also read one user’s objections to the overly prettified results from the AI tool.

Help your downsizing clients create their legacy

Decluttering to downsize might be challenging some of your clients. It’s partly a matter of how many decisions have to be made. After all, a mere one-inch stack of photos holds 100 pictures, according to a presentation I recently attended by Matt Paxton, host of the PBS program Legacy List. Another challenge is the emotions tied to the people and memories associated with one’s possessions.

I summarized some of Paxton’s tips in “Help your downsizing clients create their legacy.”

Brown rice salad recipe

I enjoyed this brown rice salad, which I made with leftovers. I didn’t have most of the vegetables that the recipe called for, but I substituted others.

Thank you, engaged readers!

I am grateful for the engaged readers who supported my newsletter during the many years that I circulated it via Constant Contact. So I asked those identified by Constant Contact as “engaged” if they’d like to receive a brief email notification once this newsletter is published on my blog. I was very touched by the many requests and lovely notes that I received in response. Thank you! (And a special thanks to Warren!)

Please email me if you’d like to join the list.

What my clients say about me

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Susan has an exceptional ability to tailor investment communications to the sophistication level of any audience. She has an uncanny ability to make very complex investment and/or economic topics accessible and understandable to anyone.”

“Susan’s particularly good at working through highly technical material very quickly. That’s very important in this business. A lot of people are good writers, but they have an extensive learning curve for something they’re unfamiliar with. Susan was able to jump very quickly into technical material.”

Improve your investment commentary

Attract more clients, prospects, and referral sources by improving your investment commentary with 44 pages of the best tips from the InvestmentWriting.com blog.

Tips include how to organize your thoughts, edit for the “big picture,” edit line by line, and get more mileage out of your commentary.

Available in PDF format for only $9.99. Buy it now!

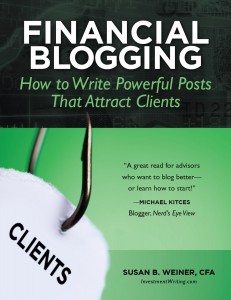

Boost your blogging now!

Financial Blogging: How to Write Powerful Posts That Attract Clients is available for purchase as a PDF ($39) or a paperback ($49, affiliate link).

Hire Susan to speak

Hire Susan to speak

Could members of your organization benefit from learning to write better? Hire Susan to present on “How to Write Investment Commentary People Will Read,” “Writing Effective Emails,” or a topic customized for your company.