Mutual fund marketing is the focus of this week’s guest post by Dan Sondhelm. His post originally appeared on SunStar Strategic’s FundFactor blog.

What’s a tomato got to do with getting your fund discovered?

by Dan Sondhelm

Have you ever grown a tomato? If so, you know it’s not as simple as just putting a seed in the ground. In fact, passionate tomato farmers often start their seedlings indoors several weeks before planting season. Once outside, they need a good dose of sunshine and the right amount of water, not to mention great soil, shelter from chill winds and a strong trellis. You get the idea.

Growing a fund requires similar specialized knowledge and attention. According to Morningstar, in the open-end mutual fund industry of over $7 trillion assets, the top 10 fund firms hold 58%. That’s one big tomato! The next 40 hold 28%, while you and the remaining 600 plus firms compete for the remaining 14%. And, fund flows follow a similar pattern.

In the past few weeks, I’ve been privileged to speak on panels addressing distribution for smaller funds. I’ve met dozens of smaller fund managers there. Some are managers with unique investment processes. Others are experts in their asset classes, still others have amazing performance. Yet, they’re frustrated by lack of fund flows, anxious about mounting expenses and hungry for ideas about how to get the recognition they deserve in this crowded market place. So, how do you differentiate your fund from the others and get discovered?

Like growing tomatoes, gaining visibility – and resultant sales – requires commitment. As a small firm, you’re competing for attention with firms who spend significant dollars on their marketing activities, both in the advisor market and at the retail level. They spend hundreds of thousands of dollars for TV commercials, glossy magazine style annual reports and sponsorships with major distribution platforms and public venues.

Making the Commitment to Grow.

Distribution is at the heart of the potential for success. But just getting on platforms is the equivalent of tossing your tomato seed in the dirt and hoping for the best. Successful distribution lies in nurturing the effort. Like adding water and light, protecting from the frost and spraying for bugs, growing your fund requires consistent attention. You have to ensure you’re in the right channels, and that advisors and investors know you, know your people and know your products.

We understand smaller firms are often made up of a handful of people. Not all firms can afford a wholesaling staff or have resources to sustain a significant marketing presence. So, how do you make it work?

Design a Distribution Strategy.

Write it down. Make someone accountable for each step. We all know that what gets measured gets done. Traditional marketing wisdom says you must address the four P’s: Product, Price, Place (Platforms), Promotion. This applies to fund distribution, too. But what about a fifth P, Performance? It’s true, not many investors will flock to a poor performing fund, but relying solely on performance is risky business. While performance may get you your 15 minutes of fame, performance chasers will drop your fund for the next hot item if they don’t really understand your investment philosophy and process or know the fund manager well.

Cover all the bases

Product

• Build a story around your investment process that highlights the opportunities of your asset class and process and differentiates you from your competition.

• Add personality by discussing your current sector strategy and top investment selections. Let investors know about the good decisions you’ve made in the past and the fund’s current positioning.

• And of course, commit to excellent performance.

Price

• Set competitive pricing – You’ll notice I didn’t say lower than average. Many managers think this is important, but many funds with lower-than-average expenses don’t sell. What does matter is how your fund compares overall to other funds that are selling.

• Set your share classes so that you are priced appropriately for the advisor types you are targeting. The preponderance of flows are going to no-load and load-waived shares. For smaller firms without existing relationships or sales teams, no load may be the way to go.

Place (Platforms)

• Select the distribution channels and share classes that make sense for your fund.

• Get on Schwab, TD Ameritrade, Fidelity, and Pershing – these are the most appropriate for smaller firms with limited distribution. Then, establish a relationship with your account manager, who can guide you through the maze of opportunities available to reach platform advisors.

• Be realistic in your expectations. If you have no prior relationships with wirehouse firms, you are too small to meet their criteria and/or there is no demand from their representatives, it’s unlikely they will add you to their platform in the short term.

Promotion

• Establish relationships with advisor firm research teams to get and stay on their radar. Where applicable, find out and work toward meeting criteria to be placed on preferred/recommended lists.

• Take advantage of marketing opportunities offered by some platforms. Develop a strong relationship with your account manager so you are alerted to and aware of opportunities for proprietary mailings or sponsorship opportunities at local and national events.

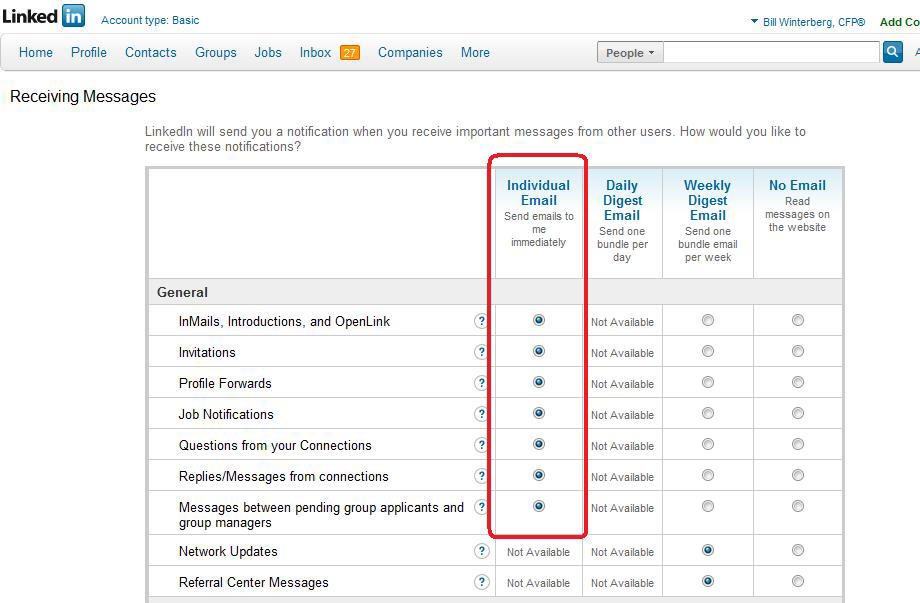

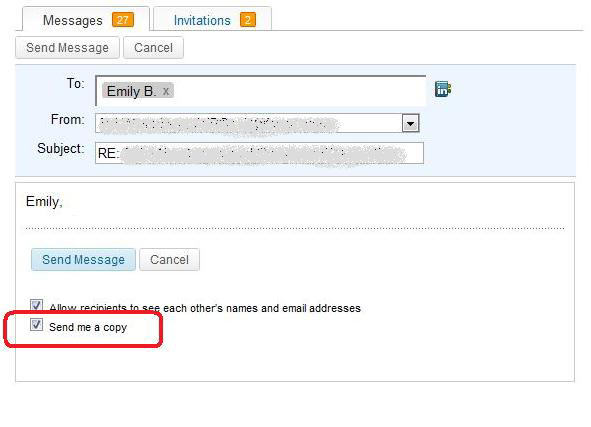

• Consider Virtual Wholesaling – use third party endorsements and technology to communicate with advisors in a structured and timely way to attract and retain investors, while building your brand.

o Proactively engage the media. Let the financial press sell you; third-party endorsed news coverage in national and local business publications adds credibility.

o Leverage third-party endorsed reprints in your other sales and marketing efforts, in print, through social networks and on your website.

o Keep your website up to date with timely commentary and news coverage. Regularly post themes about your fund and the good decisions you made. If your site doesn’t allow you to add timely information, upgrade it. Advisors won’t come back if there is nothing new.

o Communicate. Regular communication with advisors is critical in order to keep your story top of mind. Consistently offering useful, meaningful information will position you in their minds as the expert on certain topics.

o Use monthly email newsletters to drive advisors to new content and fresh ideas on your website such as recent commentaries, Webinar promotions and media coverage.

o Host Webinars or conference calls for advisors on a quarterly basis.

o Take advantage of platform outreach programs to stay in front of their advisors; many of these are free.

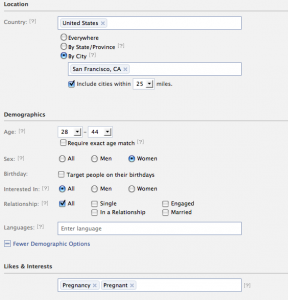

o Develop a social media strategy to distribute timely information in the networks investors frequent. Social media allows you to listen to shareholder concerns and become part of the conversation.

Growth will happen if you take the right steps. Like a tomato, the more care and attention you provide, the greater the likelihood for success. Healthy growth depends a great deal on creating relationships. With today’s email, internet and social media opportunities, expanding your reach is easier than ever before. Make a commitment to building strong relationships where advisors and investors can learn to trust and respect your firm and its expertise.

Dan Sondhelm provides personalized services to money management firms and service providers, REITs, public companies and pre-IPO companies seeking to attract and retain investors. Dan is also the executive editor of the company’s online blog, Fund Factor.

described in The Wealthy Freelancer:

described in The Wealthy Freelancer: