Some investment and wealth management firms don’t allow comments on their blogs. They think the compliance risks are too high, or the process is too time-consuming. However, it is possible to manage comments on your financial blog without too much work or expense.

The most important investments in managing your financial blog’s comments happen before your blog goes live. You must decide on your comment policy and set up your technology.

1. Decide what kind of comments to allow or delete

Some comments are sure to land your blog in hot water with the regulators and your firm’s compliance. For example, you shouldn’t allow comments that are obscene, racist, or defamatory. For compliance reasons, you probably won’t allow comments flogging a specific investment fund.

Other comments are borderline. For example, how would you respond to a post that discusses a type of asset—for example, bitcoin or other blockchain investments—that you don’t like? What about a post that vehemently disagrees with you? It’s good to anticipate these issues ahead of time. Discuss them with others at your firm, including your compliance officer.

When you develop your comment policy before opening your blog to comments, it speeds up your response. It’ll also ease your compliance officer’s concern about allowing comments. As new situations develop, it’s easy to expand your comment policy to accommodate them. I imagine that the regulators will be pleased to see a written policy.

2. Decide whether to moderate comments

The upside of moderating comments, which means that you must approve comments before they appear on your site, is that comments that you wouldn’t approve won’t ever be published.

The downside of moderating comments is that the people who write them are denied the immediate satisfaction of seeing their comments on your post. That may discourage them from commenting again.

Whether or not you moderate comments, it’s good to get comments emailed to you as soon as commenters submit them. If you’re moderating comments, this will allow you to minimize the wait that people experience before their comments appear. If you’re not moderating comments, this will let you quickly delete questionable comments.

3. Consider posting your comment guidelines for the public

Posting comment guidelines for the public can be useful. This is especially true if you think you’ll receive comments that aren’t outright spam, but that you may not wish to allow on your blog.

For example, the SEC’s rules against client testimonials mean that you will probably delete any comments that could be viewed as testimonials. A client who praises you in a comment may be puzzled, or even feel hurt, when you delete such a comment. If you share your guidelines, clients will realize that your deletion isn’t directed against them. Similarly, a person who recommends an investment with the best intentions, may feel better after reading your comment guidelines.

In “Blog comment guidelines for financial advisors: Russell Investments example,” I share one large asset manager’s guidelines.

4. Set up your technology to minimize and manage spam

If you’re a small business blogger like me, you may use WordPress as your blogging platform. There are some WordPress settings that can help. For example, look at the “Discussion” section under “Settings” on your WordPress dashboard.

There you can:

- Require that commenters give their name and email

- Automatically send to moderation any comment that has a number of links that you specify

- Automatically turn off commenting after a set number of days (spammers tend to target older posts that have attracted lots of traffic)—I reluctantly implemented this change earlier this year.

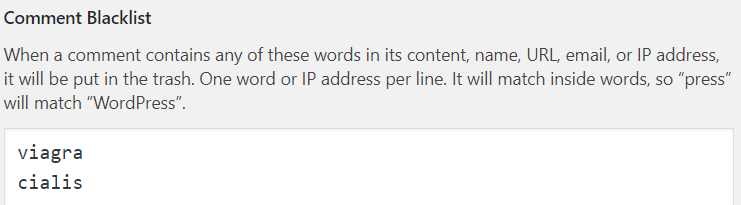

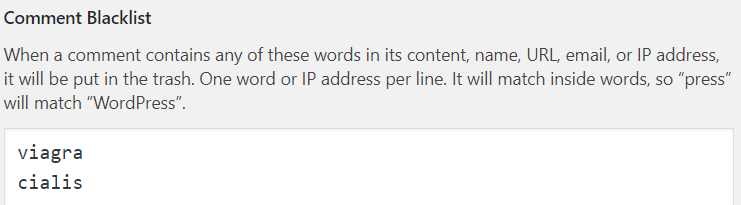

- Create a blacklist that will automatically send comments containing those words to spam (see image)

Create a spam comment blacklist using WordPress

You can learn about more settings you may use in “10+ Best Anti-Spam Plugins for WordPress 2018.” I’d like to thank Bruce Miller of SlashYourPhoneBill.com, my colleague in the American Society of Journalists and Authors, for this link.

You should also consider installing a plug-in to fight comment spam. I use Akismet. You can find alternatives in “10+ Best Anti-Spam Plugins for WordPress 2018.” If you find one you like, please let me know.

Why the fuss about spam comments?

You may wonder why I’m making a fuss about spam comments. If you’re an investment, wealth management, or financial planning professional, you need to be concerned about compliance.

However, even people like me should seek to minimize spammy comments. Links from disreputable websites will damage the reputation of your website. Here are some posts that explain why: