The future of investment management in Boston was the focus of a panel presentation to the Boston Security Analysts Society’s annual meeting on June 24.

The view that Boston is being left behind made the greatest impact on me, but I’ll report some of the opinions of the four speakers, all of whom are industry veterans.

Reamer: Emphasis on actively managed equities hurts Boston

The investment world is shifting toward aggressive hedge funds and passive quantitative funds, said Norton Reamer, vice-chairman and founder, Asset Management Finance LLC. There’s also currently an emphasis on fixed income. This is because the public has been discouraged by the stock market returns of the past two years. They want defensive, safe investments. On a related note, large pension funds are moving more toward indexing.

These trends don’t favor Boston, the home of the original mutual fund, because local firms emphasize actively managed mutual funds. At least these trends don’t bode well in the immediate future.

For Boston to prosper, it must attract assets from around the world, said Reamer. However, he sees the action shifting to New York, London, and even Philadelphia and California. Boston has only one of the 10 largest hedge funds and three of the 30 largest. While Boston has a history of venture capital, venture capital is less important than private equity, which is concentrated elsewhere, said Reamer.

One of Reamer’s comments held a glimmer of hope. Universities–along with arbitrage groups, traders, and others–are the source of the new ideas that are changing the investment world. Boston has some great universities. Perhaps the universities can fuel the region’s resurgence as an investment center. I’m happy to note that the Boston Security Analysts Society’s program committee has a subcommittee devoting to inviting speakers from academia.

Putnam: Four trends will create many losers, few winners

Investment management is a craft, said Don Putnam, managing partner of Grail Partners, who moderated the panel. He emphasized the need to avoid losing sight of the craft before he described the four trends that he believes are changing the industry.

As a result of these trends, there will be many losers and few winners, said Putnam. The winners will be global firms as well as small cadres of capable people. The big challenge for money management will be to connect these two groups.

Trend 1: The long, complicated supply chain is reordering. For example, people are seeing the problems with “the slices taken off for people who deliver golf balls.” I assume Putnam was referring to wholesalers and the broader issue of 12b-1 fees and the like, though he said that he was not making a case for fee-only advisors. Changes are coming as a result of regulatory pressures, client demands, and “better mousetraps,” such as ETFs and active ETFs. Putnam said he’s sceptical about growth opportunities for the mutual fund industry.

Trend 2: The relevance of specialization is declining. Why? Because the efficient frontier–and the need to diversify into many slices of the market–has been challenged. “It has been proven to be nonsense for the client,” said Putnam. Clients’ “true utility equation” can be delivered more efficiently with quantitative solutions, he added.

Trend 3: The arithmetic of the investment business is changing with the rising importance of asset allocation. As the utility of money management has declined, fees have risen, said Putnam. This can’t last. While clients have bought the “myth of comfort and control,” the past three years have increased client dissatisfaction.

Trend 4: Technology is increasing in importance. Technology should be woven into every aspect of money management, said Putnam. Technology’s influence on money management has barely begun.

Manning: Structure your firm to have an edge over your competition

You must deliver great results to keep assets, said Robert J. Manning, who spoke as CEO of MFS Investment Management, but is scheduled to become the firm’s chairman on July 1. This means you must structure your firm to have an edge over your competition. Manning discussed three key elements of MFS’ structure.

1. Follow a long-term investment philosophy. The world is preoccupied with short-term investment returns. However, MFS believes that you need a culture of long-term investing backed by an appropriate compensation structure. When MFS conducts performance reviews, it only considers periods of three years or longer.

2. Create a global footprint. If your people are only in Boston, you can’t be a winner, said Manning. For example, if you don’t have staff in Europe, you can’t respond quickly enough when credit default swaps widen in Europe. As part of the global footprint discussion, Manning emphasized the need to integrate the firm’s fixed income and equity teams.

3. Analysts are more important than portfolio managers. The old model is broken, said Manning. The most important employees are career analysts who have expertise in specific sectors. MFS has eight global sector heads. These are the people who, if they “see a storm coming” get the entire firm out before it hits.

The increased importance of analysts has been driven partly by the fact that clients want to buy “specialized sleeves of alpha.” This is reflected in analysts’ compensation. At MFS, analysts earn more than portfolio managers.

We sell the global research platform, not the portfolio manager, said Manning. The portfolio manager simply assembles the alpha streams from the analysts the way that clients want.

Hughes: Confident in Boston’s future

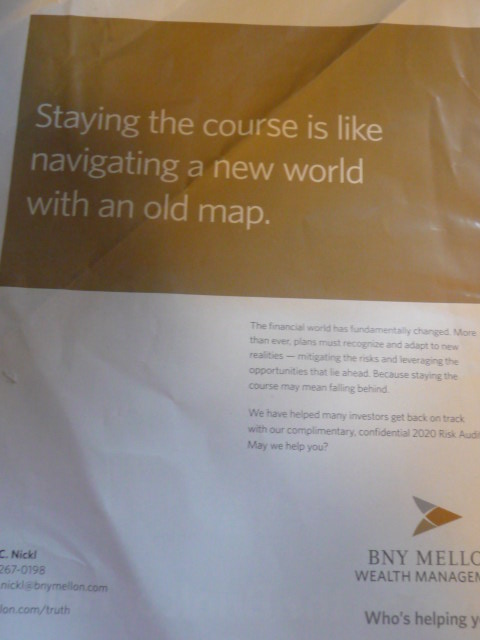

Larry Hughes, CEO of BNY Mellon Wealth Management, said that Boston’s talent and innovation makes his firm feel confident about Boston’s future.

Still, the next decade will pose challenges for wealth managers in terms of how to protect clients against continued market volatility and how to capture the related opportunities. Hughes suggested three areas for focus.

1. Investment innovation–The “set it and forget it” ways of the past won’t work any more, said Hughes. It’s important to capture trends that develop–and disappear–in months, or perhaps even just weeks.

2. Seamless and dynamic planning–Wealth managers must “plan across silos,” considering all aspects of clients’ lives, including taxes, estate planning, health care, and more.

3. Better manager-client engagement–It’s important to speak in your clients’ terms. Clients don’t talk about the efficient frontier, standard deviation, or r-squared, said Hughes. So neither should wealth managers. Instead, wealth managers should present issues in straightforward terms, such as “helping you maintain your lifestyle.”